Having little cash in your bank account at the end of the month feels nauseating for many people. When I was paying off debt, I often had next to nothing in my account at month end. That feeling brings dread and evokes the sense that you will never have relief.

Thankfully, it is possible to stop living paycheck to paycheck. With some effort you can do far more than make ends meet. In fact, you can turn things around and find success. This guide shares how.

Table of Contents

How Do You Break the Cycle of Living Paycheck to Paycheck?

Financial hardship is a lonely feeling, but it is possible to break free and become financially stable. Unfortunately, many Americans live on the wrong edge of financial wellness.

Nearly 70 percent of Americans regularly live paycheck to paycheck, according to Nasdaq. Earning more doesn’t solve the issue either as over 50 percent of six-figure income homes report not being able to make ends meet.

Here’s how to stop living paycheck to paycheck and achieve your long-term goals.

1. Create a Budget

Getting on a budget is vital to creating a monthly positive net cash flow. This allows you to create a plan for your money, as well as see where all of your cash goes.

Furthermore, a budget helps you identify where you can cut costs to provide some relief.

Thankfully, it’s not that difficult to start. You want to begin by writing down all of your monthly expenses. Then, write down your income, including everything from your day job and side hustle.

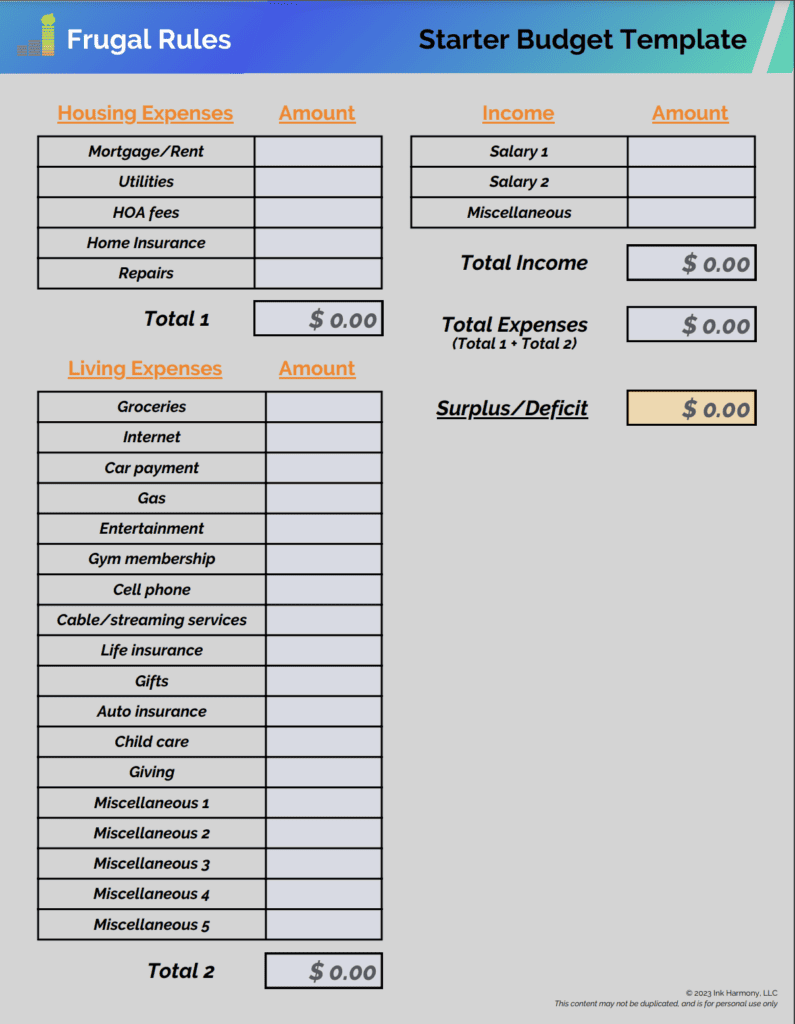

You can download our sample budget template below to start a basic plan. Input your monthly income in the “Salary 1” field.

If you have a partner, put their salary information in the “Salary 2” field. Any income you earn on the side should go in the “Miscellaneous” section.

Then, fill out the expense fields with the costs that apply to you. After you supply all of the information, you should see a surplus or deficit line on the bottom right of the spreadsheet.

Download Our Free Starter Budget Template NowIf you’re new to money management, budgeting apps are a terrific way to simplify the process. Read our guide on the top Mint.com alternatives to identify the best choices.

Don’t overthink it when you start your budget. It’s personal finance, so customize it to your situation.

Read our guide on how to create a budget to learn the steps you need to take to optimize it.

2. Reduce Your Spending

Budgeting is fantastic in one key area – it reveals to you where every dollar goes each month. Get real with yourself and look for areas where you are overspending.

You want to ask yourself what value you receive from needless spending. Additionally, be real with what your life will look like if you cut back on those areas.

Ultimately, you only need four things:

- Food

- Shelter

- Transportation

- Utilities

Everything else can be open to cutting. Some examples include:

Unused subscriptions: If you haven’t used the service or subscription in the last six months, cancel it for instant savings.

Cable: This is an easy expense to cut if need to break the paycheck to paycheck cycle. The top alternatives to cable can help you slash costs. Here is a breakdown of the top live TV choices.

| Service | Cost | Channels | Streams | DVR | Rating | Trial |

|---|---|---|---|---|---|---|

| Hulu Live | $76.99+ | 85+ | 2 | Unlimited | 4.1/5 | Try |

| fuboTV | $79.99+ | 180+ | 10 | 1,000 hrs. | 4.2/5 | Try |

| DIRECTV STREAM | $79.99+ | 65+ | 20 | Unlimited | 3.7/5 | Try |

| Philo | $25 | 70+ | 3 | Unlimited | 4.3/5 | Try |

| Sling TV | $40+ | 30-50+ | 1-4 | 50 hrs. | 4.2/5 | Try |

| Vidgo | $69.99+ | 110+ | 3 | N/A | 4/5 | Try |

| YouTube TV | $72.99+ | 100+ | 3 | Unlimited | 4.2/5 | Try |

Dining out: This is another fantastic way to increase savings. If cutting it out completely feels impossible, cut it in half to save some money.

None of these reductions have to be permanent unless you find you can live without them. However, they provide easy ways to lower your monthly spending to help create breathing room in your budget.

3. Start an Emergency Fund

Life is full of the unexpected. Your car breaks down, or you need to replace an item in your home and you need to pay to fix or replace it.

An emergency fund is the best way to prepare for these events. This account is the best protection you can have to ensure against accruing needless credit card debt. It’s also not meant to pay for unexpected expenses, but legitimate emergencies.

A fully-funded emergency fund has three to six months of living expenses. Don’t let this amount of money scare you from starting to save as you won’t achieve it overnight.

Instead, establish a short-term goal of saving $500, then $1,000. Use that amount as a springboard to reach one month of living expenses.

You can even use a banking app, like Spruce Money, to help you establish and pursue this goal. It’s free of charge and has lots of helpful features.

Automating your savings is the best way to build your savings. Most banks and employers let you establish a connection for free.

A high-yield savings account at online bank is often best as they have little to no fees and offer competitive rates. CIT Bank is our favorite choice and offers some of the top rates available and the minimum opening balance requirement is just $100.

Read our guide on how to grow an emergency fund to learn more.

4. Increase Your Income

Cutting back on spending isn’t the only way to stop living paycheck to paycheck. It’s also likely you need to increase your income.

You can only cut so much, so it may be necessary to make extra money. The additional funds can help increase debt repayment, build up your budget, save for retirement, and more.

Start with your current day job to learn if there are any opportunities to increase your income. Next, you may need to start a side hustle to add another source of income.

Flexible side gigs are going to be your best choice to work around your full-time job. You can even pursue under the table jobs that pay in cash. Just remember to hold back some of the earnings to pay taxes.

Our top choice is to deliver or drive with Uber. You can deliver meals from local restaurants or drive riders to a particular destination.

Think outside the box to come up with side hustle ideas to increase your income and the additional funds wisely. Putting money toward what is going to help you the quickest is the best way to manage the extra cash.

Read our guide on how to make money on the side to identify the best choices to increase your income.

5. Attack Debt

High-interest debt is a common cause of living paycheck-to-paycheck. The interest can be suffocating and make it difficult to pay off debt and achieve financial stability.

This is particularly true in a climate of rising interest rates, which only increase the burden. If you’re in debt, do the following:

- Stop creating more debt

- List out all of your debt

- Create a plan to pay it off

The debt snowball approach is a popular way to kill debt. Here is how it works.

| Step | Action |

|---|---|

| 1 | List your debts by balance size |

| 2 | Make extra payments on the smallest balance |

| 3 | Pay off the smallest balance |

| 4 | Apply extra payments to the next smallest balance |

| 5 | Repeat the process until you become debt-free |

Alternatively, you can use the debt avalanche methodology. This is how the avalanche philosophy works.

| Step | Action |

|---|---|

| 1 | List your debts by balance size |

| 2 | Make extra payments on the higher interest rate debt |

| 3 | Pay the minimum on all other debts |

| 4 | Repeat the process until you become debt-free |

Either method works. Select the one you believe will work best for you and attack the debt with a vengeance.

If you have high interest credit card debt, you may find rates to be too suffocating. Debt consolidation is one potential choice that allows you to lower interest rates and intensify your repayments as more goes towards the principal.

It works similar to student loan debt consolidation. You combine the debt into one amount, allowing you to only make one monthly payment.

This may provide some relief if you’re paying more than 20 percent in interest on your credit cards. Do your due diligence before choosing a lender to consolidate your indebtedness.

Read our guide on the best places to get an unsecured personal loan to identify one that fits your needs.

SoFi is our top choice that offers competitive rates and may help you pay off debt faster.

6. Grow Your Savings

An emergency fund is essential to stop living paycheck to paycheck. It’s part of a philosophy that actively looks for ways to save money.

However, don’t just stop with your emergency savings. It’s best to actively look for opportunities to cut back and apply those savings towards other needs.

Potential areas include:

- Retirement planning

- Saving for buying a house

- Vacation planning

- Saving for your children’s college fund

- Planning for other large expenses

Having no savings will make all of those goals more difficult to achieve.

*Related: Have a check you need to cash? Here’s our guide on the best places to cash a check near me to get money now.*

CIT Bank is a fantastic choice to grow your savings and has a minimum opening account balance of $100. Start an account and automate transfers to it every pay period.

Read our guide on ways to save money every month to identify other money-saving opportunities.

7. Monitor Your Spending

Living paycheck to paycheck can easily become a way of life. If you’re not on top of your finances, it’s easy to backslide to old spending habits.

A helpful way to avoid this is to regularly monitor your spending. Look for areas where lifestyle inflation is occurring and curtail it.

Having additional resources feels good, especially when it’s the result of cutting spending. However, don’t get too comfortable and start spending those resources on things that bring little value.

Tiller is a helpful budgeting app that can help you avoid overspending. It puts all the activity from your checking account into a Google or Excel sheet.

You can use this information to monitor your spending and monthly payments. This helps you make informed decisions to improve your finances.

What to Avoid

It’s understandable to want a quick fix when you’re dealing with financial stress. It takes a lot of work, but it is possible to stop living paycheck to paycheck.

However, here are some things to avoid when you’re in a financial bind.

Payday loans: Payday loans market themselves as a way to alleviate your budgetary pain. That is a lie. Payday lenders often charge exorbitant interest rates and create a cycle of debt.

Read our guide on payday loan alternatives that will serve you better.

Paycheck advance apps: Cash advance apps are a popular tool to gain access to your paycheck before you receive it.

Unfortunately, they’re only a temporary solution and can establish a dangerous cycle, which can potentially impact your credit score. Read our guide on apps like Dave to learn more.

Credit Cards: Credit cards can be an effective tool to manage your finances. They can also be a horrible way to inflate your spending. Worse yet, using them unwisely can cause you to incur debt.

If you’re struggling with your cost of living, consider a side hustle over a credit card. Delivery jobs like DoorDash are a good choice to make more. Use your earnings to cover your needs instead of misusing a credit card.

The above resources pitch themselves as a solution to make ends meet. They’re a mirage, at best, and provide little relief. It’s best to look for ways to spend less and earn more to break free from your situation.

Bottom Line

We all crave freedom. Living paycheck-to-paycheck is not freedom. It’s overly burdensome. Breaking the cycle takes work and persistence.

Achieving freedom requires knowing your why. Why do you want to live a better financial life? That is personal to you, but it provides the motivation necessary to continue the fight and reach the destination you desire.

How often do you review your monthly budget?

I’m John Schmoll, a former stockbroker, MBA-grad, published finance writer, and founder of Frugal Rules.

As a veteran of the financial services industry, I’ve worked as a mutual fund administrator, banker, and stockbroker and was Series 7 and 63-licensed, but I left all that behind in 2012 to help people learn how to manage their money.

My goal is to help you gain the knowledge you need to become financially independent with personally-tested financial tools and money-saving solutions.

Living paycheck to paycheck is the worst! We did it for a really long time – even though we made plenty of money. We broke the cycle by drastically cutting our spending until we got to the point where we were living on a portion of our income.

Completely agreed Holly. We did virtually the same thing – we learned to be satisfied with what we had and not spend on stuff that took us farther away from our goals.

I think many people live paycheck to paycheck because they aren’t willing to make any sacrifices. I’m not saying everyone, but a lot. I know many people who complain about money, but I see them eating out, playing volleyball tournaments, etc. What’s it going to take??

Excellent point Tonya. I know that was the case for me in the past. I think it often takes seeing your situation being a direct result of your choices.

“No sooner did breathing room appear than it would quickly vanish into thin air. Payday came and went, with everything spoken for.” The real truth, right there in writing. I am so grateful for the day when I learned (thanks to you, Grayson and others) that we didn’t have to live paycheck to paycheck. It IS possible to break the cycle!

Well, thanks Laurie. 🙂 I’m thankful I learned it as well. Life is not meant to be lived struggling along because of poor choices.

As a spender, I find coming from a place of “no” works really well to stop living paycheck to paycheck. Also, paying myself first (automating savings) is huge for me.

Yes on the automating savings! That makes it so much simpler to tackle in my opinion.

I think sometimes just having the realization that you don’t have to live that way (paycheck to paycheck) is liberating. There’s a cultural expectation that we should spend everything we make, but it’s just not so. In my experience, learning to live on less is a lifelong gift Mr. FW and I gave ourselves!

That’s a great point. I find it can feed on itself the more you surround yourself with those who have that mentality. They equate a “good life” as one filled with spending or accepting debt as “normal.” It doesn’t have to be that way.

Good stuff as usual. Hard to break this cycle, needs lifestyle changes and new set of values at times. This points put some of the hidden things like food waste, it’s sometimes surprising what you turn up in potential savings by looking at everyday habits. And it doesn’t take becoming a minimalist, although that wouldn’t be bad either.

Thanks Miles. I agree. I’ve spoken with many people who just don’t realize the money they’re throwing away through simple choices and it all adds up.

We were living paycheck to paycheck just a few years ago. We did three main things to change that: we stopped eating out as much, we bought WAY less clothing and material items, and we started side hustling.

Sounds like a great plan to me and it obviously worked. 🙂

I think it’s important to recognize whether or not your income is the problem. Below a certain threshold of income, you aren’t going to frugalize your way to savings and financial progress. But I think the more common problem is recognizing that one has enough income, and is just over-spending, or perhaps not spending as strategically as possible. That distinction is important so you can work the right angles–focusing first on making more or spending less, whichever applies. Of course it’s good to do both but it can be overwhelming and even defeating to tackle too much at once.

Completely agreed Kalie. It sort of goes back to what I mentioned – saving is great but it’ll only take you so far when, really, focusing on both that and income production is best like you said.

I think you bring up an important point though – realizing you have enough coming in but not spending/saving as you should.

John there is one thing I would add that you left out. You did a great job of covering the cost-cutting measures people should take, but it seems to go from there to earning extra money. I didn’t see any mention of increasing income at your 9-5, which can have a much more material impact than a side hustle and typically does not require using any more of your free time to get those extra $. Overall I agree with everything you said, but too often people are too comfortable at their current job/employer and aren’t willing to take some risks and step outside their comfort zone when it comes to their 9-5.

I completely overlooked that DC – I added in a few sentences about that. Chalk it up to me not being in an office I guess. 😉 Seriously though, that is a good point. I think so often it’s easy to overlook what’s staring us right in the face and finding ways to make extra at where you’re already working would definitely fit into that.

I think a big mental part of living paycheck to paycheck is how normal it seems. You could go your whole life and never know anyone who doesn’t live that way. I’m so thankful for the PF community who don’t live “normally.”

Completely agreed Kim. I too thought it was normal – thankfully we both have a new “normal.” 🙂

Sometimes it is an income issue, so earning more helped me. I never made a lot on a nonprofit salary, so just barely afforded my rent and student loan payments. I think spending less, earning more, and socking away money can really help.

Hey Melanie! I would agree – in many instances it simply comes down to income and what you’re bringing in. I wouldn’t say that’s always the case as you can make a decent salary and make foolish spending choices and end up in a similar situation.

This was a fantastic read, thanks!!

We sort of live paycheck to paycheck…haha. Let me explain. We save a LOT each month, so whenever we get paid, we put money in savings, pay all our bills that are due or just that we could pay (we’re way ahead on most bills) and then leave some money in the account for food/gas/etc. So, if we spend all our food/gas/etc money before the next paycheck comes, we are sh** out of luck haha. I would say we usually leave justttt enough to make it to the next payday!

Thanks Sarah! Ha ha, we’re very similar as well – a lot of what we bring in goes to retirement and other savings we have going on so we just truly operate on what’s needed and not much else.

Reading this article helped me realize my spending is a habit I can change, and paying attention to WHY I spend makes a huge difference. I learned that I spend money I should be saving to a) make someone else happy, b) keep up with the Jones’ c) make up for bad prior planning or d) splurge as a “reward.” What’s so amazing is how ingrained these behaviors are, almost unconscious. Usually it’s not until I’ve spent the money and I feel bad I realize I wanted to put that money in the bank. Don’t get me wrong, we save and invest, but I find I can and should do better. Rainy day funds can never be too high!

So many people live paycheck-to-paycheck! The sad part is that many people don’t have to, but they choose to by their consumption choices. The only way to break the cycle is to stop buying liabilities, and start investing in appreciating assets, and assets that generate income. It’s not so bad living paycheck-to-paycheck when those paychecks are from passive investments!

I was surprised at the percentage of people who don’t have any savings accounts! I would be so nervous if that was me. When you cut down to spending on just the essentials, you realize how little you actually NEED to get by day to day.

I know, but it’s the sad truth. Having money saved is vital at any time, and much more during a pandemic like we’re facing.

I totally agree with all these things mentioned above. Side hustle jobs are a big help with helping to combat the struggle to get by these days. When I got laid off back in 1991, I had a son less than 7 months old, and a daughter going into kindergarten. Starting over is never easy, but I was determined to keep my home and feed my family. For 9 years I worked 2 jobs and hardly ever had time to spend with my family, much less holidays or any gatherings. I missed watching my children grow up and school functions, all because I had to work. But I will tell you that it was the right decision doing this so that my wife was there to take care of the kids. You learn from the past and when you can start saving and paying off bills, in the long run its a win win situation. Everyone should be trying to put away something in savings in case of an emergency during these difficult times, and those side hustles can be a big help as well. Great article and well said my friend.

Yep, starting over is never easy but with effort it’s usually possible to make headway. Completely agreed on saving something. I don’t care what the amount is, in the beginning, just start, build the practice, and let it build momentum.