Many believe you can’t invest in the stock market with little money. I was guilty of the same belief. I just finished paying off debt and thought I needed thousands of dollars to invest in stocks. As a stockbroker, I spoke with a number of people who believed it’s impossible to invest in stocks with little money.

This myth not only held me back, but it holds many new investors back from growing their wealth. From a certain perspective, it’s understandable why many think you can’t invest in the stock market with little money. Investing is often confusing, and it’s made worse by the belief that only wealthy people can make money in the stock market.

You don’t have to be an expert to invest in the stock market. You also don’t need to have thousands of dollars to start investing money. There are many tools that can help the most novice investors do quite well, even with limited resources.

Table of Contents

How to Invest in the Stock Market with Little Money

As with many aspects of personal finance, the key to investing is to develop good habits and find resources to help. This gives you the confidence to start, which is vital to growing your wealth.

If you have held back from investing due to lack of funds, this post is for you. Here’s how to start investing in stocks with little money, starting today.

Grow Your Available Funds

Saving money is closely tied to investing in the stock market. In order to start investing, you first need to have money to invest. This does not take as long as you think.

Many online brokers allow you to start investing for $500 or less, so that gives you a perspective of how much you need to start investing.

If you don’t have the available funds to start investing, there are countless ways to save money. You can start keeping change you receive and put it in a cash jar. You can eat out one less time a week or month.

The extra money will add up soon enough, providing you with several hundred dollars to start investing.

There are many ways to save money every month you can use to build the cash needed to start investing. Select a few and you’ll be surprised at how quickly you can build up an extra $500.

Better yet, you can automate savings to an online money market account like CIT Bank, which pays 1.55 percent on your cash. This lets you build funds to enable you to invest, and also builds the habit of saving money.

*Related: Are you starting with little money? Read our guide of the best passive income apps that let you start investing with minimal resources.*

Don’t want to wait to invest in the stock market? There are choices, discussed later, that will help you start today.

Use Your Employer

If you want to know how to get into the stock market with little money, the best option is through your employer-sponsored 401(k) plan.

In most cases, everything for your 401(k) is handled through your employer and you can put your investing on autopilot.

Why is a 401(k) the best choice for investing in stocks with little money? It’s quite simple:

- You can start investing with no money

- You can set up automatic transfers from each paycheck

- Your employer may match what you contribute – that’s free money

- Most 401(k) plans offer free resources to help you learn about how to start investing in the stock market

Each 401(k) plan is different. While some employers may make you wait several months, most allow you to start investing when you begin a new job.

Just ask your employer when you start when you can begin investing in your 401(k). Here’s our guide on how to set up your first 401(k) to help you start if you’re new to investing in a 401(k) plan.

Have Someone Manage Your Investments

Many people ask “how can I invest with little money?” and believe there are no available resources to help them invest. Thanks to robo-advisors, that is not the case.

A robo-advisor is a digital platform that helps you invest money based on your specific goals. Think of a robo-advisor as alternative to automate your investing.

Using a robo-advisor not only helps remove the emotion from investing, but it also helps ensure your investments are performing as the should. The best part is many robo-advisors have no minimum balance requirement and are very cheap.

Betterment is a great option for those looking to invest in the stock market with little money and get assistance managing their investments. Betterment has no minimum balance requirement.

You can start investing with as little as you want, and can contribute as little as $10 at a time.

When you open an account with Betterment they ask you a small handful of questions. They use your responses to build your portfolio. Betterment also charges a minimal annual fee of .25 percent of your assets with them.

You can check out our Betterment review to get a more in-depth look of the tools they have to offer.

M1 Finance is a terrific alternative to Betterment if you want to retain some control of the investing. M1 realizes some people want to actively manage their investments.

Once the platform learns your goals they give you the ability to create an investing pie.

This pie houses stocks and Exchange-Traded Funds (ETFs) of your choice. M1 monitors the pie from there to ensure it continues to align with your goals.

This service is free of charge, and you can invest $100, if that is all you have to start.

If you’re a hands-off investor, you can choose from one of the 60 pre-made pies M1 Finance offers. We describe those in our review of M1 Finance.

SoFi Automated Investing is another good choice if you want to invest in the stock market but don’t have a lot of money to get started. Like Betterment, there’s no minimum investment amount.

If you lack the time or need help, SoFi Automated Investing can make investing easier for you. They’ll help you build, manage, and rebalance your portfolio at no cost to you.

Think of using a robo-advisor like Betterment, M1 Finance, of SoFi Automated Investing as having a financial advisor, and all their resources, for minimal cost. If you’re new to investing and still learning how to invest with little money, a robo-advisor can be a great option.

Invest with a Micro Investing App

The financial tech space makes it simpler to invest in the stock market with little money. Thanks to what’s known as a micro-investing app, you can invest small amounts in stocks, ETFs, or index funds to grow your wealth.

There are several micro-investing apps worth considering if you’re new to investing, each with their respective perks. Here are the best micro-investing apps to consider:

Acorns: Acorns made their name as an app that rounds up purchases to the next dollar amount for you to invest. For example, if you spend $3.01 on a loaf of bread you have $0.99 to invest in stocks.

Acorns allows you to select between a handful of low-cost ETFs for investing. The platform also offers numerous educational resources to help you learn how to invest in stocks.

Acorns is free to use if you’re in college, or under 25. It costs $3 per month after that.

Read our review of the Acorns app to learn more.

Robinhood: Robinhood is a free-to-use micro-investing app that lets you invest in stocks and options. It doesn’t allow retirement accounts, but they have no minimum balance requirement and you can invest with as little as you want.

Unlike other investing apps, Robinhood allows you access to the entire stock market, so you can invest in any stock you wish.

Read our review of Robinhood to learn more.

Stash: Stash is another free-to-use micro investing app. However, they differ from Robinhood in they let you buy partial shares of stock and index funds. They also offer retirement accounts.

You do need at least $0.01 to start investing with Stash, but if you deposit $5 or more they give you $5 when you sign up! Read our Stash review to learn how the platform works.

If you need to invest in the stock market with little money, a micro-investing app is a good option to start and build confidence.

Invest in Low Initial Investment Mutual Funds

Mutual funds are another great way to start investing with little money, especially for beginners. These types of funds group together stocks and bonds into one basket, making them a perfect alternative for beginners or those wanting to passively invest.

*Related: Want to invest in real estate but don’t know where to start? Read our guide on how to invest in real estate with no money for the best available choices.*

Mutual funds don’t trade like stocks, trading only once a day after the stock market closes. Another way mutual funds differ from stocks is they often have a minimum initial investment, typically $1,000 or more.

However, some mutual funds waive this if you agree to invest $50 or $100 per month. This gives you the benefit of automating your investing, plus you can start with little money.

Many mutual fund families allow you to directly invest through them. However, for sake of ease, it’s usually best to manage these types of investments through an online broker like Vanguard or Fidelity.

Don’t Give Into Excuses

It’s challenging to figure out how to invest in stocks with little money. When you don’t have a lot of extra money at the end of the month, it’s easy to delay long-term needs like investing.

That sentiment makes sense. Unfortunately, it overlooks the major point of investing – time. Giving your money more time in the stock market is the best thing you can do for your future self, thanks to compound interest.

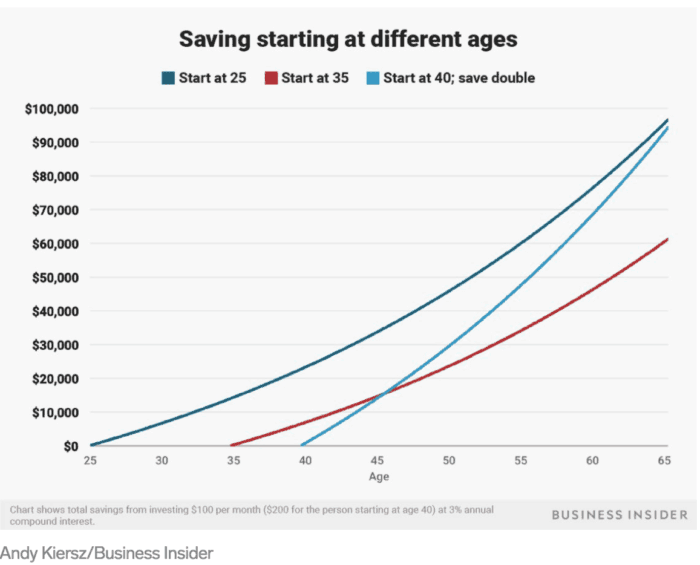

Take a look at the below graph from Business Insider as an example of how compound interest works.

As you can see, the earlier you start, the less money you have to save as it has more time to grow. On one level, it doesn’t make sense, but it shows how important time is when it comes to investing in the stock market.

It’s easy to think the amount you can put in the stock market each month will do nothing. I once felt the same way. Now I realize that thinking only holds you back from growing your wealth.

Saving for retirement may not be a priority for you now, but there are many other reasons why you may need to invest, such as:

- Buying a house in the future

- Go on exotic vacations

- Helping your child pay for college

There may be many other reasons, but in every case more time can only help you meet your goals.

Bottom Line

If you legitimately have no money to invest in the stock market, look for ways to free up money. You can find ways to cut spending or find ways to bring in additional income by asking for a raise or starting a side hustle.

Also realize that you don’t need to have thousands of dollars to start investing in stocks. In most cases you can start with $500 or less. If you don’t have that initial lump sum, you can also start with $50 or less per month.

Ultimately, the amount you begin with really doesn’t matter. What matters is developing the discipline of investing and giving your money time to grow.

I know the amount may seem like it will do nothing, but thanks to compound interest, it can have a significant impact on your future.

What are some other ways to invest in the stock market with little money? Why do you think many believe you can’t invest in stocks with little money? When did you start investing?

SoFi Invest refers to the three investment and trading platforms operated by Social Finance, Inc. and its affiliates (described below). Individual customer accounts may be subject to the terms applicable to one or more of the platforms below.

1) Automated Investing and advisory services are provided by SoFi Wealth LLC, an SEC-registered investment adviser (“Sofi Wealth“). Brokerage services are provided to SoFi Wealth LLC by SoFi Securities LLC.

2) Active Investing and brokerage services are provided by SoFi Securities LLC, Member FINRA/SIPC, (“Sofi Securities”). Clearing and custody of all securities are provided by APEX Clearing Corporation.

3) SoFi Crypto is offered by SoFi Digital Assets, LLC, a FinCEN registered Money Service Business.

For additional disclosures related to the SoFi Invest platforms described above, including state licensure of SoFi Digital Assets, LLC, please visit SoFi.com/legal.

Neither the Investment Advisor Representatives of SoFi Wealth, nor the Registered Representatives of SoFi Securities are compensated for the sale of any product or service sold through any SoFi Invest platform. Information related to lending products contained herein should not be construed as an offer or pre-qualification for any loan product offered by SoFi Bank, N.A.

I’m John Schmoll, a former stockbroker, MBA-grad, published finance writer, and founder of Frugal Rules.

As a veteran of the financial services industry, I’ve worked as a mutual fund administrator, banker, and stockbroker and was Series 7 and 63-licensed, but I left all that behind in 2012 to help people learn how to manage their money.

My goal is to help you gain the knowledge you need to become financially independent with personally-tested financial tools and money-saving solutions.