Investing in real estate was once something only open to people with significant means.

Fortunately, crowdfunding platforms like Fundrise have leveled the playing field by allowing almost anyone to add real estate investments to their portfolio.

If you want to grow your passive income, our Fundrise review can help you determine if they’re a fit for your needs.

Table of Contents

What is Fundrise?

Fundrise is a real estate crowdfunding platform that began in 2012. Now one of the most well-known players in the space, the company allows non-accredited investors to get into real estate with as little as $10.

The Fundrise app removes the need to physically manage properties as well as the need to have significant sums of money to pursue real estate investing.

This greatly expands the opportunities for people to invest.

Over the past decade, the platform has performed over $5 billion in transactions and has paid out over $100 million of dividends to investors.

How Does Fundrise Work?

When you open an account, you choose one of five options. In order of investment minimums, these include:

- Starter

- Basic

- Core

- Advanced

- Premium

Regardless of your selection, your money is placed into a real estate investment trust (REIT).

| Features | Starter $10+ | Basic $1,000+ | Core $5,000+ | Advanced $10,000+ | Premium $100,000+ |

|---|---|---|---|---|---|

| Dividend reinvestment | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Auto-invest | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Invest via IRA | ✔️ | ✔️ | ✔️ | ✔️ | |

| Create and manage goals | ✔️ | ✔️ | ✔️ | ✔️ | |

| Customize strategy | ✔️ | ✔️ | ✔️ | ||

| Priority access | ✔️ |

This eREIT houses a variety of properties, similar to how an ETF holds different stocks.

Investment properties can include any of the following:

- Shopping centers

- Mixed-use properties (commercial and residential tenants in one property)

- Multi-family apartments

- Single-family housing

You don’t invest in individual properties. Instead, you have a diverse portfolio of different properties.

The eREIT isn’t publicly traded, though they do allow you to liquidate your holdings once a quarter provided you give a 30-day notice.

If you invest more in your account, additional properties become available in your investment portfolio.

How Much Does the Platform Cost?

Property management holds many people back from investing in real estate since they lack the skills to manage a property or the funds necessary to do so.

Fundrise manages that for investors, resulting in a cost to use the platform. They also provide a wealth of educational materials and incur expenses from purchasing properties.

There are two investment fees Fundrise charges for using their online real estate crowdfunding platform. These include an investment advisory fee and an asset management fee.

Investment Advisory Fee

It’s important to understand the fees with any investment opportunity. Luckily, Fundrise is transparent in what they charge investors to use their platform.

The investment advisory fee is a nominal 0.15 percent annual fee. For example, if you invest $1,000, you can expect to pay $15 in yearly fees.

Asset Management Fee

All account holders pay an asset management fee of up to 0.85 percent annually. If you invest $1,000, you should expect to pay $85 in fees a year.

Fundrise is competitive within the crowdfunding real estate space and is relatively low cost.

Fundrise Features

Each online investing platform operates a little differently. Here’s what sets Fundrise apart from its competitors.

Low Minimum Investment Requirements

Fundrise has the lowest minimum requirement to open an account in the industry. For just $10, you can open an account and get started in private real estate investing.

Many other investing platforms require at least $500. While that does lower the barrier to entry for people to invest in real estate, it may still hold some investors back.

Read our guide on the best ways to start investing with $500 or less if you want to identify other options.

You Can Invest in an IRA

Investing in residential real estate is a fantastic way to diversify your portfolio. However, gains can impact your taxable situation.

Fundrise alleviates that by allowing users to house investments in a Traditional IRA. This also helps you shelter gains from taxes until you withdraw them for retirement.

There is a $125 annual custodial fee to be aware of for IRAs, so keep that in mind as you consider your options. Read our guide on the top places to open a Roth IRA online if you want to avoid the fee.

They also allow trust accounts in addition to individual and joint accounts.

You Don’t Need to Be Accredited

Investing in residential or commercial real estate used to always require you to be an accredited investor.

An accredited investor is someone who meets one of the following three requirements:

- Earned at least $200,000 (or $300,000 if married) a year for the previous two years

- Has a net worth of at least $1 million

- Is Series 7, 65, or 82 licensed, in good standing

You don’t need to meet those requirements to open an account with Fundrise. They do offer opportunities for accredited investors in their Premium account level, but that’s not required to start investing.

Excellent Diversification

You don’t typically invest in a single-family housing unit with the platform. Each eREIT includes a variety of investment properties, allowing for instant diversification.

If you combine this with investing in stocks, you can increase your diversification and further help your entire portfolio better weather potential storms.

Fundrise regularly adds new properties to its platform to increase your investment options.

Debt and Equity Investments

Two legitimate ways to invest in real estate include debt and equity. Debt allows you to lend money to property owners.

Equity lets you own a stake in properties. Each of these investment styles has its own purpose, and you can choose either with Fundrise to further enhance your investing.

Goals-Based Investing

If you open an account with at least $1,000, you can utilize their goals-based investment approach. This opens up more investment opportunities for users.

It also allows you to pick a specific strategy. These include:

- Balanced

- Passive income

- Aggressive growth

If you’re not sure which strategy you should choose, they provide a small questionnaire to help you determine which is best for your situation.

What are the Minimum Requirements to Invest at Fundrise?

Until recently, you needed at least $500 to open an account with Fundrise. It is now possible to invest with just $10.

This lets you invest in their Starter portfolio and has numerous options for a diversified portfolio of eREITs to choose from.

The Starter portfolio is an equal mix of income and growth-related investments.

What is the Average Rate of Return on Fundrise?

Investment returns are an essential component of growing wealth. Fundrise has had a healthy rate of return over the past several years.

Here is how they have performed since 2014, after fees:

- 2014: 12.25 percent

- 2015: 12.42 percent

- 2016: 8.76 percent

- 2017: 11.44 percent

- 2018: 9.11 percent

- 2019: 9.47 percent

- 2020: 7.4 percent

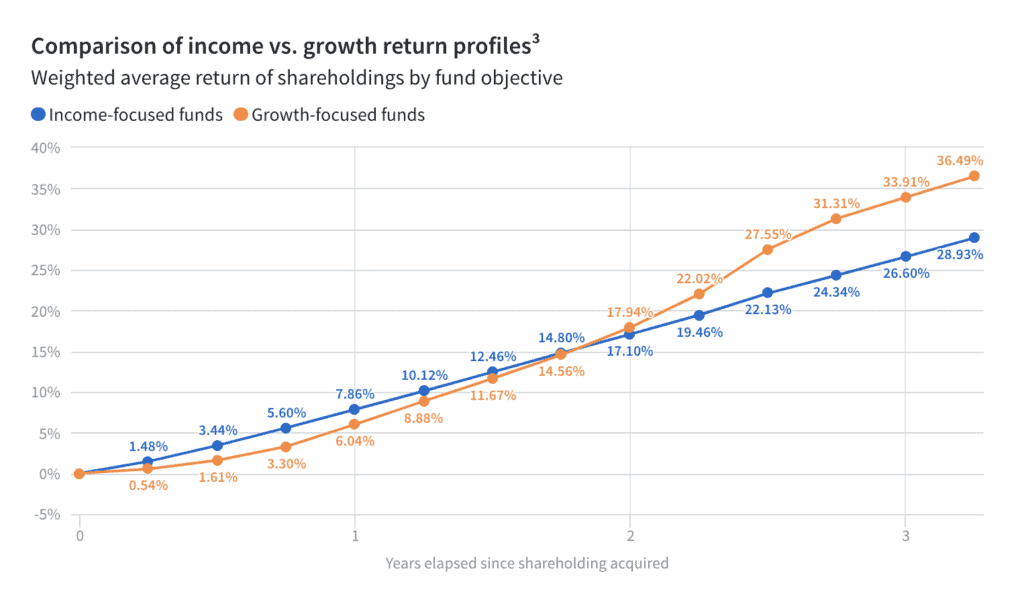

Depending on if you choose income vs. growth portfolios, you will experience different gains between the two.

Here’s how the two have performed since inception.

This compares well against the stock market. The S&P 500 has had an 8% average historical return since 1958, so Fundrise fairs well as an alternative to stocks for wealth creation.

How to Redeem Your Fundrise Shares

You can only liquidate your Fundrise shares by submitting an online request at least 15 days before the calendar quarter ends. When the redemption window opens, they will begin selling your shares.

It can take several weeks for the company to transfer the cash into your bank account.

The platform typically charges an early redemption fee for shares you’ve owned for less than five years.

Here is the early redemption fee depending on how long you hold them:

- 90 days up to three years: Three percent

- Three years to four years: Two percent

- Four years to five years: One percent

- Longer than five years: Zero percent

If you own the shares for less than 90 days, you can sell them within the introductory period and receive your initial purchase price back.

Who Should Use the Platform?

Not certain if you should invest with Fundrise? Here’s who should use the platform.

Long-term Investors

Unless you’re a flipper, investing in real estate is often not a fit for short-term investors. Residential or commercial real estate investing is an excellent way to grow your wealth, but it takes time.

Like the stock market, real estate experiences ups and downs. Risk is inherent, as is opportunity. But, it doesn’t happen overnight.

If you have a long-term view, Fundrise can be a nice addition to your investment portfolio.

If you don’t want to tie up your funds, read our guide on the best short-term investments to pursue to identify some suitable choices.

Newer Investors

We all have to start somewhere, and Fundrise is an excellent way for new investors to invest in real estate with little money.

Not only can you start with as little as $10, but they also have an extensive library of educational resources to get started.

They even vet all properties before making them available, so you don’t have to choose them on your own.

Who Shouldn’t Use Fundrise?

Not all investing platforms work for everyone. Here’s who should look elsewhere for investment opportunities.

People Who are Cash Strapped

Investing, regardless of the vehicle, is a great way to grow your wealth. However, real estate investing isn’t a short-term game.

It often takes several years for returns to materialize, tying up your money. If you have minimal savings, you may want to wait until you increase your savings.

The stock market could be a better option, but you will still want to have some emergency savings before beginning.

People Who Avoid Risk

Risk is inevitable with investing. You find it in the stock market, and it’s just as prevalent in real estate.

If you’re very risk-averse, you may want to hold off on starting a Fundrise portfolio. Instead, educate yourself on the basics of investing in real estate, then you can consider trying the platform.

Pros and Cons

There’s a lot to consider when choosing an investment platform. Here’s what to keep in mind about Fundrise:

Pros:

- Open an account with as little as $10

- 90-day introductory period

- Invest in both commercial and residential real estate

- Terrific way to grow passive income

- Don’t need to be an accredited investor to use the platform

- Lots of educational resources

- Invest in IRAs

Cons:

- Investments are illiquid

- Dividend distributions are taxed as ordinary income

- Can’t hand-select investment properties

Overall, Fundrise is a legitimate choice for beginners to invest in real estate.

How Does Fundrise Compare Against the Competition?

Fundrise isn’t the only crowdfunded real estate platform in the space. Here are a few competitors that fare well against them.

| Company | Min. Investment | Fees | Best For | Sign Up |

|---|---|---|---|---|

| Fundrise | $10 | 1% | New investors | Try |

| DiversyFund | $500 | Free | Residential real estate | Try |

| Roofstock | $5,000+ | Free | Rental properties | Try |

| CrowdStreet | $25,000+ | 1% | Commercial real estate | Try |

DiversyFund

DiversyFund is a top competitor to Fundrise. The platform doesn’t require you to be an accredited investor, and you can open an account with as little as $500.

It uses an eREIT model for investment choices. DiversyFund also invests in multi-family properties, so it’s a fantastic choice for residential real estate.

The best part is that DiversyFund does not charge any fees to use the service.

Roofstock

Roofstock is a bit unique in comparison to Fundrise. Instead of eREITs, you invest in turnkey rental properties with Roofstock.

You can buy and sell properties on the platform, and they manage the entire process for you.

There’s no minimum to start, but you must have a 20 percent down payment to purchase properties. It’s open to both accredited and non-accredited investors.

Fees vary depending on if you’re buying or selling. However, they are competitive.

Read our review of Roofstock to learn more.

CrowdStreet

CrowdStreet is a suitable alternative for accredited investors with at least $25,000 to invest. The perk of CrowdStreet is you get to personally select investment properties.

Commercial real estate is the prominent investment option on CrowdStreet. That’s not something available on other platforms.

The platform is free to use, but expect a management fee of 0.50 to 1.00 percent. Like Fundrise, this is competitive within the market.

Fundrise Review

-

Pricing and Fees

-

Tools

-

Ease of Use

-

Customer Service

-

Investment Options

Fundrise Review

Fundrise is a leading crowdfunded real estate investing platform that lets people invest in real estate with as little as $10.

Overall

4.1Pros

✔️ You only need $10 to start investing ✔️ Open to non-accredited investors ✔️ Often pays quarterly distributions ✔️ Variety of educational resources for new investors ✔️ The platform vets all properties for investment potential

Cons

❌ Is highly illiquid ❌ You must pay taxes on distributions if not using a retirement account ❌ Unable to invest in individual properties

Summary

Fundrise is one of the easiest ways to start investing in real estate. However, you should only invest cash you don’t need for at least five years since commercial real estate is a long-term investment.

If you want to invest in real estate and have limited funds, you can do so with as little as $10.

What are your thoughts on investing in real estate? How are you currently working to grow your wealth?

I’m John Schmoll, a former stockbroker, MBA-grad, published finance writer, and founder of Frugal Rules.

As a veteran of the financial services industry, I’ve worked as a mutual fund administrator, banker, and stockbroker and was Series 7 and 63-licensed, but I left all that behind in 2012 to help people learn how to manage their money.

My goal is to help you gain the knowledge you need to become financially independent with personally-tested financial tools and money-saving solutions.

Leave a Reply