If you’ve never done it before, investing in the stock market can be overwhelming. Yes, stocks do carry risk. However, they also offer one of the best opportunities for long-term wealth building.

Intimidation aside, one of the best ways for beginners to start investing in stocks is to open an online investment account. This account can be used to invest in individual shares of stock, mutual funds, exchange-traded funds (ETFs), and more.

The essential piece is to start. Time is the best gift you can give to your efforts, regardless of the starting amount. This guide shares how you can get into investing, at any level of comfort.

Table of Contents

How to Invest in Stocks

Investing isn’t difficult. Patience and a desire to begin growing your money over time are all that’s required. Here are nine steps to getting started as an investor.

1. Know Your Goals

Before you begin investing of any kind, you need to know your goals. You must have your finances in order to begin the process of knowing your goals.

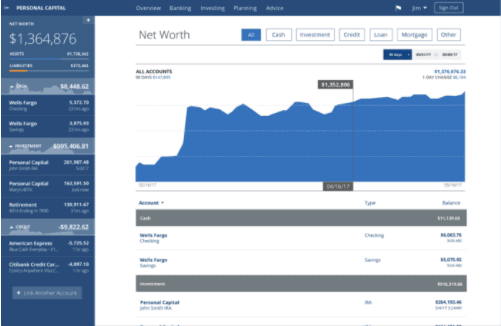

If you don’t have your finances organized, Empower is a free tool to use to do that. It’s our favorite money app as it allows you to organize all of your finances in one spot.

Your goal should include several things, like:

- Career – how much are you earning, and do you have the funds to invest in the stock market?

- Debt- what does your debt situation look like, and will it hinder your efforts to grow wealth?

- Budget – do you have funds in your budget to start investing?

- Family situation – do you have a new baby, or are you a newlywed? Either may impact your access to funds.

The answers to these questions, and possibly more, are necessary to help you determine why you need to start investing.

- Are these accounts meant to help you save for retirement?

- Will you need the money in the next few years?

- Is this money for you only, or does someone else have access to it?

Each situation is different, so it’s essential to use the above questions to set your investment goals.

2. Determine the Type of Investor You Are

Before you put money into stocks, you need to know what kind of investor you are. Most brokerages will ask you this before opening an account, so be prepared to answer.

There are two general types of investors:

- Passive investors who take a set-it-and-forget-it approach

- Active investors who want to be involved with their investments, and possibly trade individual stocks

Both are good ways to invest money, but it’s important to know which you are before starting.

3. Choose an Investing Account

To invest in stocks, you need an investment account. Full-service brokers and discount brokers alike offer numerous account types, such as:

- Individual or joint accounts

- Roth IRAs

- Traditional IRAs

- 401(k)s

Each account type acts differently. If you want to save for retirement an IRA is best, but if not, you may want to open an individual or joint account.

Now that you know what kind of investor you are, you need to choose a path to follow. If you want to be actively involved with your investments, discount online brokers are a good choice.

If you want a set-it-and-forget-it approach, or want help with your investments, a robo-advisor is best.

DIY Route: Open a Brokerage Account

An online brokerage is the fastest and most affordable path to stock investing. They often have minimal deposit requirements, have reduced or no fees, and have a variety of investment vehicles.

SoFi Invest is a terrific option and features all of these characteristics. The brokerage lets you open an account with just $1 and has no fees required. Other features include:

- Trading of partial shares

- No commissions

- Expert-created ETFs exclusive to SoFi

- Cryptocurrency trading

- User-friendly options trading

The broker also offers a wealth of educational resources to help as you start.

Passive Route: Work With a Robo-Advisor

Do you want help with your investments, or are you new to the stock market? A robo-advisor is an excellent resource. They act as a financial advisor, managing your money, but at a greatly reduced rate.

Betterment is a leading robo-advisor, being one of the first in the space as well as being one of the largest. After answering a few questions, they create a custom portfolio of low-cost ETFs for your situation.

They also rebalance it to ensure it’s on track to reach your goals.

They do this for a mere 0.25 percent of your assets annually. So, for example, if you invest $10,000, it costs $25 a year.

Betterment offers loads of educational resources, numerous account types, and cash management to help with your money.

4. Learn the Difference Between Investing in Stocks and Funds

Regardless of whether you’re choosing the DIY or hands-off approach, you need to know the difference between stocks and funds. It sounds complicated, but it’s straightforward. Here is what to know about the two investing choices:

Individual stocks: These represent ownership in a specific company. Take Amazon, for example. If you want to invest in Amazon, you can buy a share or multiple shares of the stock.

You can create a diversified portfolio with individual stocks, but it takes work. Additionally, there is increased risk if you buy shares in only a company or two. However, there’s also increased upside if the company outperforms expectations.

Mutual funds or ETFs: Mutual funds and ETFs are a basket of stocks. They invest in multiple, often hundreds or thousands of stocks. Picking this as an investment lets you get access to numerous holdings without having to purchase each stock individually.

Another choice within ETFs is an index fund. These hold the same investments as an entire index. The Spider 500 Trust is an example of this, as it invests in every company included in the Standard & Poor’s 500 index.

The benefit of an ETF or index fund is that you get instant diversification. The tradeoff is that you may not experience the same potential for significant growth that you might get with an individual stock.

5. Use Dollar-Cost Averaging

Dollar-cost averaging is another term that seems difficult, but it’s easy to understand. The idea is to gradually buy into your investments.

Take the same $10,000 example used for Betterment. Instead of investing the entire amount at once, you drip in $1,000 or $2,500 every month until the entire amount is in the market.

Work-based retirement plans, like the 401(k), follow this philosophy. They ensure you don’t buy at the top of the market and that you’re regularly investing.

Most brokers allow users to set up automatic deposits to be used for investments, making it simple to accomplish.

6. Educate Yourself

This step could really be at the beginning of the guide, as it’s so essential. Investment vehicles like ETFs and index funds reduce the need to immediately start with this step.

However, if you want to move beyond such choices or stop the hands-off approach, education is necessary to become a good investor. There are countless resources to help with your investing in the stock market.

Most, if not all, brokerages offer free training, tools, and screeners to help guide your investment journey. The internet is full of resources, as are many 401(k) plans.

Other resources, like the Motley Fool Stock Advisor help users through expert analysis to find suitable stocks to invest in for retail traders.

Don’t overlook additional resources, such as:

- Investing books

- Reading The Wall Street Journal

- Watching CNBC

- Reading online investing boards

- Free paper trading on platforms like Tornado (formerly Nvstr)

There are innumerable resources to help you formulate an investment strategy thats works for you. Find one you understand and use it to guide your investment choices.

7. Focus on the Long-Term

Stock investing seems like betting to some people, but those who focus on the long-term commonly come out ahead. The stock market may perform poorly in one year, only to follow it with significant growth the following year.

Looking at the ten years ending in 2020, for example, the stock market had an annualized return of 13.9 percent, before inflation. Not every year returned that amount, but over the course of the decade it did on an annual basis.

*Related: Do you want to invest in real estate but have limited funds? Check out our guide of the best real estate crowdfunding sites that let you invest with little money.*

Over the last century, the stock market has returned roughly ten percent a year, on an annualized basis.

The old adage holds true; what goes down in the market will go up. This brings the toughest ideal: once you buy an investment, don’t look at it everyday. It will only cause stress and waste your time.

8. Diversify Your Investments

Diversification is an essential aspect of investing in the stock market. Think of diversification like a diet, it’s not wise to eat only a few things.

You want to eat a variety of things to have a well-balanced diet, such as:

- Vegetables

- Fruit

- Protein

- Healthy fats

- Carbohydrates

You get the idea. The same is true with the market. It’s best to be investing in a range of assets to manage your risk. Asset classes can include:

- Stocks

- Bonds

- Cash

- Commodities

- Real estate

Having a diversified portfolio helps you weather a storm when one asset is down as there is minimal correlation between the two. Think of it as a way to easily minimize risk.

Many ETFs help you invest in asset classes that breed diversification. A robo-advisor like Betterment can help you accomplish the same thing.

9. Start Now

A common myth is that you need a lot of money to begin investing in stocks. That is not the case. There are more tools than ever that let you start investing small amounts of money.

From micro-investing apps to 401(k) plans, opportunity is available for most people to build multiple streams of income.

If you wait until you have tons of money to invest, you overlook the most important part of investing – time. Time is the best gift you can give your investment efforts, thanks to compound interest.

The longer you wait, the more you need to invest.

If you wait to start investing for retirement until 45 vs. 25, you must put away three times as much, according to the Center for Retirement Research.

Small amounts may seem like they will do nothing, but they will. Even if you can only invest $500 to start, begin with that and let time work its magic.

Breaking it Down

The stock market is intimidating for a lot of people. If you feel that way, don’t let it stop you. Here’s a basic guide to investing in stocks for beginners, if you don’t think you can start:

1. Determine you goal. If you’re new to the market, it’s likely you need to start saving for retirement, but nail down your goal before beginning.

2. Open a brokerage account. There’s no shame in being a novice to stocks and bonds. There are resources, like Betterment, to help you start down the path of growing your wealth.

3. Educate yourself. There are many resources to learn how to start investing. You only want to invest in things you understand, and taking advantage of free tools will go a long way to help.

4. Make saving a regular habit. Saving and investing share a similar philosophy. It doesn’t happen in a vacuum, but happens over the long-term. Make saving and putting money into the stock market a regular habit and your portfolio will thank you. Read our guide on how to multiply your money to identify ways to amplify your savings efforts.

Investing is a journey, not a one-and-done exercise. You don’t need to be an expert to start, just wise enough to want to grow your wealth.

Bottom Line

Don’t be intimidated by the idea of investing in stocks. Everyone has to start somewhere. It doesn’t matter if you can invest $100 to start or are a novice.

By following this foundational advice and avoiding fear, you too can begin to grow your wealth.

When did you start investing in the stock market? What’s one thing you’ve seen hold people back from starting to invest? Are you a boring or sexy investor?

SoFi Invest refers to the three investment and trading platforms operated by Social Finance, Inc. and its affiliates (described below). Individual customer accounts may be subject to the terms applicable to one or more of the platforms below.

1) Automated Investing and advisory services are provided by SoFi Wealth LLC, an SEC-registered investment adviser (“Sofi Wealth“). Brokerage services are provided to SoFi Wealth LLC by SoFi Securities LLC.

2) Active Investing and brokerage services are provided by SoFi Securities LLC, Member FINRA/SIPC, (“Sofi Securities”). Clearing and custody of all securities are provided by APEX Clearing Corporation.

3) SoFi Crypto is offered by SoFi Digital Assets, LLC, a FinCEN registered Money Service Business.

For additional disclosures related to the SoFi Invest platforms described above, including state licensure of SoFi Digital Assets, LLC, please visit SoFi.com/legal.

Neither the Investment Advisor Representatives of SoFi Wealth, nor the Registered Representatives of SoFi Securities are compensated for the sale of any product or service sold through any SoFi Invest platform. Information related to lending products contained herein should not be construed as an offer or pre-qualification for any loan product offered by SoFi Bank, N.A.

I’m John Schmoll, a former stockbroker, MBA-grad, published finance writer, and founder of Frugal Rules.

As a veteran of the financial services industry, I’ve worked as a mutual fund administrator, banker, and stockbroker and was Series 7 and 63-licensed, but I left all that behind in 2012 to help people learn how to manage their money.

My goal is to help you gain the knowledge you need to become financially independent with personally-tested financial tools and money-saving solutions.

Great overview of how to get started, John. I think investing in a retirement account is the first step that the vast majority of people should take. There really is no need to mess with individual or personal stock accounts until you have started to consistently invest in tax-advantaged retirement accounts.

Thanks DC! I’d agree that it makes most sense to start saving for retirement first – especially if you have access to a 401(k) with match. A non-retirement account does make sense, in time, but retirement needs to come first.

Great, comprehensive guide on getting started investing, John! My husband convinced me we needed to start contributing to his 401k (enough to get the match) in our mid 20s (when we had very little money). I’m glad he did. Though it took a few years, seeing the initial growth gave me the motivation to invest even more. We’re very boring investors – index funds all the way!

Thanks Amanda! That’s something I wish I could go back and change. It is small, but it’s seeing that growth and developing that discipline that counts. Yep, we’re boring too. 🙂

Im interested in investing outside of my 401k. I’ve been leaning heavily towards getting started with a robo-advisor. This guide will definitely help me make my final decisions!

I have cats AND stocks! What do I win?

Great overview on getting into the stock market.

Ha! You win a better future. 🙂

Great guide John. Where I struggle is taking the time to review my investments. For my 401K I have all my investments in index funds, but I’m not 100% certain these are my the best choices my employer has to offer.

I should set up sometime similar to you to review my investments. I already do this with my budget but not with investments. But, this is important because I could be losing money in the longrun.

Thanks Chris. Yea, what I do with our investments takes such little time and pays off in the long run. I’d imagine the Index Funds would be ok, unless they’re in some obscure funds that are high in fees or you’re overlapping investments.

This is a great little overview, John.

I personally love choosing individual stocks, but funds are a great alternative for people not interested in that side of things!

Probably the most important point for me here is to make investing a habit – results will always be haphazard without this.