Staying on top of your bills is essential if you want to improve your finances. Rocket Money can track your due dates and monitor how you spend your money so you can avoid unexpected expenses.

The app can also help you cancel unwanted subscriptions, make a budget, and provide personalized suggestions to improve your spending habits. These free and premium features are useful if you’re on a tight budget.

Our Rocket Money review reveals how the various app features can help lower your monthly bills and which membership tier is ideal for your needs.

Table of Contents

What is Rocket Money?

Rocket Money is a personal finance app that was initially launched in 2015 as Truebill. The app rebranded under its current name in 2022 after being acquired by Rocket Companies.

It connects to your bank accounts and credit cards to download recent expenses, retrieve your current account balances, and forecast your monthly spending. You can see the details in easy-to-read charts that you can categorize for increased accuracy.

This money app also provides personalized suggestions to help you save money, such as reducing recurring expenses.

How Does the Rocket Money App Work?

Rocket Money is mobile-only and accessible from Android or iOS smartphones and tablets. You can sign up from a web browser but must download the app to link your accounts and utilize the finance tools.

There are free and paid pricing plans that offer various money management tools specializing in reducing expenses and planning for future purchases.

Core features available to all members include:

- Account balance syncing

- Bill negotiation

- Budgeting

- Canceling unwanted subscriptions

- Credit score monitoring

- Downloading transactions

- Fee refunds

- Payment reminders

You can easily keep tabs on your spending, create a budget, and receive personalized insights with this free budgeting app.

A premium subscription makes assessing your complete financial picture easier since there are more automated features to reduce current expenses and plan long-term financial goals. Additionally, a paid membership is needed for joint accounts.

Some of the platform’s premium tools include:

- Automated savings

- Cancellation concierge

- Creating unlimited budgets

- Credit report updates

- Exporting data

- Net worth tracking

- Premium chat customer service

- Real-time account balance updates

- Shared accounts

If you prefer unlimited app access or the convenience of automated features, the paid subscription is better.

How Much Does Rocket Money Cost?

The free version never incurs fees, but you’ll have limited capabilities. For example, you can only make a basic budget and can’t request on-demand account updates.

For any paid membership, you choose how much you want to pay based on what you think is fair.

The app offers a seven-day free trial to decide if you’ll benefit from the in-depth features, including the ability to create unlimited budgets, net worth tracking, and more hands-on customer support.

Upgrading to Rocket Money Premium costs between $3 and $12 monthly. An annual subscription costs $36 or $48 and is billed upfront.

Although it’s an optional service, a one-time fee applies when the bill negotiation feature successfully lowers a recurring subscription like your cable or cell phone bill.

Features

Here are the various tools that can help you take better control of your financial life.

Account Syncing

You can start by linking your bank, credit card, and investment accounts to the app. The service uses Plaid to connect securely. It’s possible to exclude specific accounts that you don’t use to pay bills or don’t want the app to monitor for privacy.

After connecting to your financial institution, the free plan updates your account balances and transactions daily. In comparison, premium members have on-demand access and can see their real-time balance throughout the day.

Being able to link your accounts for free is one of this app’s most valuable features since you can track every purchase and know exactly how you spend your money.

Bill Negotiation

The negotiation service is initially free for all users and is an effortless way to see if you qualify for discounts on expensive recurring subscriptions. Then, after analyzing your spending habits, the app will prompt you when it believes it can reduce an expense.

Contract-based cell phone plans, cable TV, and home internet have the most savings potential because existing customers usually pay higher rates than new customers.

After linking your service account or uploading a recent monthly bill, a billing expert will see if discounts or newer plans can offer similar services at a lower monthly cost. If so, you pay a one-time success fee of 30 to 60 percent of the annual savings.

This fee is similar to other bill negotiation services that reduce or cancel recurring expenses. While it’s an expense, you spend less money and save time by not contacting service providers on your own.

Subscription Tracking

Free and paid users can also track how much they spend monthly on recurring bills like their phone, internet, or streaming services. Tapping on a particular provider lets you see how much you spend per month and is an easy way to look for billing increases.

This tool can help identify unwanted subscriptions you may want to cancel or renegotiate for a lower fee. For example, there might be a streaming service you haven’t watched in several months and thought was already canceled.

The app provides detailed steps to cancel subscriptions at no extra cost. You can tap a button to call the cancellation line or visit the cancellation page to submit your request.

Premium members can enjoy the subscription cancellation concierge, where the app automatically cancels a service at your request. This saves you time and lets you avoid a stressful phone call where the representative may pressure you to stay.

Requesting Refunds for Fees and Outages

Rocket Money searches for potential overdraft and late fees in your banking history that can be eligible for a refund. Free users can access a script to read when calling an institution to request a refund.

It’s even possible to request partial refunds during service outages, like when your satellite or internet service is unavailable for several days.

With the premium plan, the app will automatically try to request refunds and credits on your behalf.

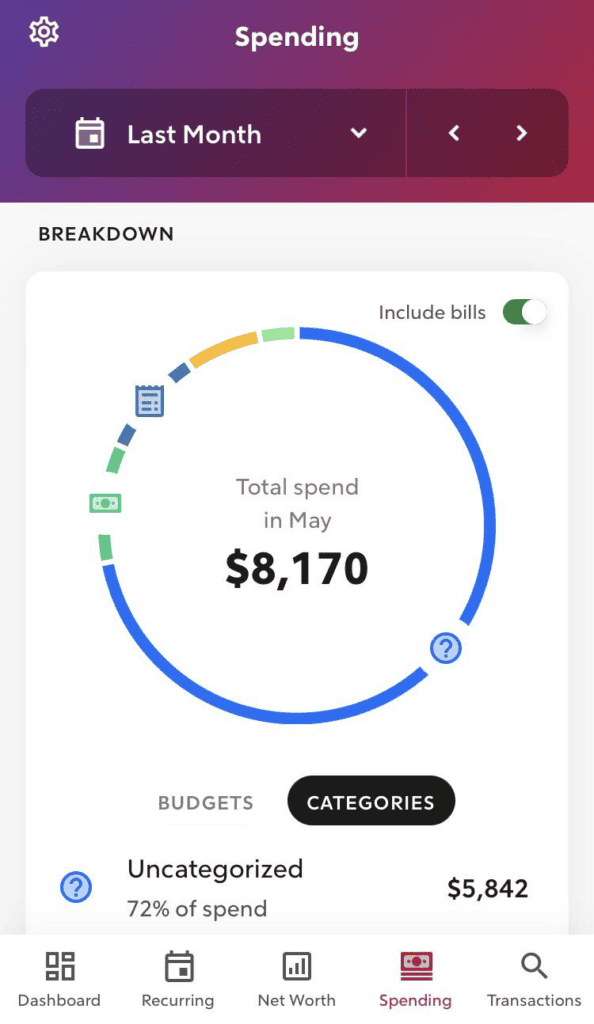

Budgeting

You can create a basic budget that helps prevent you from overspending. This feature is useful for a casual budget that requires minimal maintenance.

The free and paid budgeting tools won’t provide the in-depth insights and planning features that other premium budget software offers. Individuals who need hands-on help to create a spending plan or map out financial goals may find Rocket Money inadequate.

Free users can break down their spending into four categories:

- Bills and utilities

- Groceries

- Fees

- Everything else

The finance app will measure your remaining income for the month and your projected savings. These tools are sufficient if you want to monitor spending, but other free budgeting software can provide more in-depth features if you prefer greater detail.

Paid users can create unlimited budgeting categories and categorization rules. This customization can make it easier to know exactly how much you are spending on certain expenses when you’re serious about saving more money.

Automated Savings

Premium users can schedule recurring deposits for savings goals into a Smart Savings account. You can choose the deposit amount and frequency. Additionally, the app displays your savings progress and gives you full account control.

The money transfers from a linked checking account into a savings account at a partner bank that is FDIC insured. An overdraft protection system won’t initiate transfers when it suspects there won’t be enough remaining funds to pay your bills.

You can make multiple accounts if you want to save for several goals. For instance, you might have a vacation fund and another for a replacement vehicle.

Track Your Net Worth

In addition to being a budgeting app, the premium plan has a net worth tracker that calculates the value of your liquid assets, such as your savings and investments. You can manually add accounts and loans and update the balance as necessary.

It’s easy to enable several toggles to exclude certain assets from your net worth total. For instance, it’s normal not to count the value of your primary residence, vehicle, or checking account since you won’t sell them to invest or pay for expenses.

This feature can help monitor your overall financial progress as you reduce discretionary spending, pay off debt, and prioritize savings goals.

Credit Score Tracking

All users can view their free credit score and chart their score history in the app. It updates monthly and is the VantageScore 3.0 that uses your Experian credit report.

Premium subscribers can view their full credit report, which refreshes monthly. Seeing your full report lets you look for reporting errors and any negative marks.

How Trustworthy is Rocket Money?

Rocket Money protects your data using bank-level encryption and multifactor authentication (MFA). They also use Plaid, which is a trusted third-party service, to sync your account and avoid storing sensitive information on the app’s servers.

These security measures don’t make the app breach-proof, but the practices are similar to other personal finance platforms.

Another potential concern for individuals can be privacy. Your identity remains anonymous, but you may receive ads and product offers from Rocket Companies and third-party partners for loans, investments, or other financial services.

Pros and Cons

Here are some of the app’s strengths and weaknesses.

Pros of Rocket Money

- Free budgeting and expense-cutting tools

- Syncs with bank accounts and credit cards

- Customizable budgets and categorizations

- Easy to use

Cons of Rocket Money

- Limited free features

- Several tools require a paid membership

- Budgets are too simple for serious planning

- Mobile-only

If you need help managing your money and streamlining your expenses, Rocket Money could be worth a try.

Apps Like Rocket Money

Rocket Money makes it easy to monitor your spending and look for ways to cut costs. However, certain users might find its features lacking and may benefit from other platforms .

Here’s a preview of the top choices:

| App | Mo. Cost | Best For | Free Trial | Try |

|---|---|---|---|---|

| Rocket Money | $3+ | Canceling subscriptions | Y | Try |

| YNAB | $14.99 | Budgeting | Y | Try |

| Tiller | $6.58 | Spend tracking | Y | Try |

| Empower | $0 | Net worth tracking | N/A | Try |

These are the best alternatives to Rocket Money.

YNAB

You Need a Budget (YNAB) is a favorite for individuals who need hands-on help making an in-depth budget. This app’s primary purpose is to help you stop living paycheck to paycheck and assign each dollar you earn a job to maximize your savings.

This platform is accessible by computer or mobile device. After joining, it walks you through an extensive setup process to allocate your monthly budget for common and less common expenses.

It connects to your financial accounts, and there are many colorful charts to visualize your progress.

The service is free for the first 34 days and costs $14.99 monthly or $99 when paid annually. College students enjoy 12 months of complimentary access.

Read our YNAB vs. Mint review to learn more about the platform.

Tiller

Consider Tiller Money if you prefer spreadsheet budgets using Google Sheets or Microsoft Excel. First, you link your banking accounts. Then, the app automatically imports your transactions into a universal budget template.

Next, you can create different sheets to track specific transaction types or pursue multiple budgeting strategies. You can implement auto-categorization rules or community-created templates to make it easier to track your income and spending.

After the first 30 days, an annual subscription costs $79.

Empower

Empower (formerly Personal Capital) is a free finance app. You only pay fees if you use its wealth management services for investing.

Most people use this platform to track their net worth, make a basic budget, and receive a complimentary investment portfolio analysis.

Empower lets you create a basic budget with unlimited categories and account syncing. Of the three Rocket Money alternatives, it has the most limited budgeting capabilities, but it’s ideal for comparing your monthly spending and income.

The free net worth tracker is one of the best since you can effortlessly track liquid and physical assets. There is also an entry-level retirement planner and savings goals to map your financial future.

Read our Empower review to learn more.

Rocket Money Review

-

Ease of Use

-

Tools and Resources

-

Commissions and Fees

-

Customer Service

-

Availability

Rocket Money Review

Rocket Money is a useful personal finance app that helps you manage your budget and identify services to cancel and bills to negotiate to increase your savings.

Overall

4.3Pros

✔️ Free to use

✔️ Customizable budgets

✔️ Syncs with financial accounts

✔️ Intuitive interface

✔️ Budgeting tools are free

Cons

❌ Not all offerings are free

❌ Mobile only

❌ You may need more advanced budgeting features

Bottom Line

You will benefit the most from using Rocket Money if you want to track your expenses by a specific transaction or look for ways to reduce spending on recurring bills.

The app’s budgeting tools are sufficient for making a starter spending plan that is easy to follow and ideal for casual users who might be intimidated by more sophisticated and pricier platforms.

There is a seven-day free trial to test drive the app and decide if the free or paid version is a better fit for your financial goals. With no risk to give it a try, it’s worth checking out.

What do you look for in a money management app?

Josh uses his personal experience of paying off over $130,000 in personal debt and changing careers to write about saving money, investing, and paying off debt. He has regularly written for notable outlets including Wallet Hacks, Well Kept Wallet, and Debt Roundup.

Josh was previously an operations supervisor for a Fortune 500 company for seven years. He is married with three small children.

Leave a Reply