Several months ago my wife awoke one morning to see that her Facebook account had been comprised overnight. The hackers then gained connection to our business page. Worse yet, our business page had our credit card details. The morning raged on, learning they were able to get into a second account. Amidst the stress we realized we had to change a lot of passwords and begin contacting various service providers to ensure nothing further was compromised. Becoming a victim of stolen identity is incredibly stressful. Follow these 12 steps to get your life back.

Table of Contents

Take a Deep Breath

Having your identify stolen feels violating. It’s also maddening. Take a few moments to collect yourself, then make a plan of attack.

It will help you think more clearly, and act with decisiveness.

Analyze Recent Charges

A hacker may have a variety of motives. One of the key ones is to spend your money on something they want. Log into your credit card account to see recent charges.

If there’s anything you don’t recognize, it’s likely the hacker is busy with your card.

Call Your Credit Card Issuer

Regardless if your card is stolen, or the information has been taken, you want to call your issuing bank. Tell them what happened.

In all likelihood they will reverse the charges and cancel the card. In my case I had a new card the next day. Take this step as soon as possible so they don’t rack up a bunch of charges.

Contact Your Bank

If the hacker has your debit card information they may be accessing those funds. Tell your bank what has happened and ask what can be done.

In most cases they will offer one of two options – putting a fraud notice on your accounts, or close all of your accounts. What you select depends on how far the hacker has gotten and if they have access to your bank accounts.

Update Your Accounts

If you use the compromised card for recurring charges, you’ll want to update all of your accounts. Not doing so will result in emails from the respective companies saying the charge was declined.

Change Your Passwords

If the hacker is in any of your accounts they likely have your passwords. It’s best to change your passwords and make them stronger.

Try and make them different enough from your current one so as to not make it easy for them to figure out.

Secure Your Wi-Fi Network

This didn’t occur to us, but it is possible for hackers to access your Wi-Fi network. If you believe you’re a victim, it’s time to change the userid and password to your network. Make sure you use a strong password and not one you use for other accounts.

You may also want to encrypt the network. It’s best to consult your high-speed internet provider to learn what guidance they can provide.

Add Two-Factor Authentication to Your Accounts

Two-factor authentication is a fantastic way to add an extra layer of security to your accounts. Some companies offer it on their sites, but others don’t.

For those that don’t offer it, consider a two-factor authentication app to use on your phone. The peace of mind is worth it.

Consult Your Credit Reports

In advanced cases some hackers may try to open accounts in your name. To verify that isn’t happening, you want to look at your credit reports.

You can request one for free from each of the three major reporting agencies. If you fear some illicit activity has occurred, report it. Furthermore, you may choose to freeze your credit. That’s more involved, but don’t overlook it if you think it’s necessary.

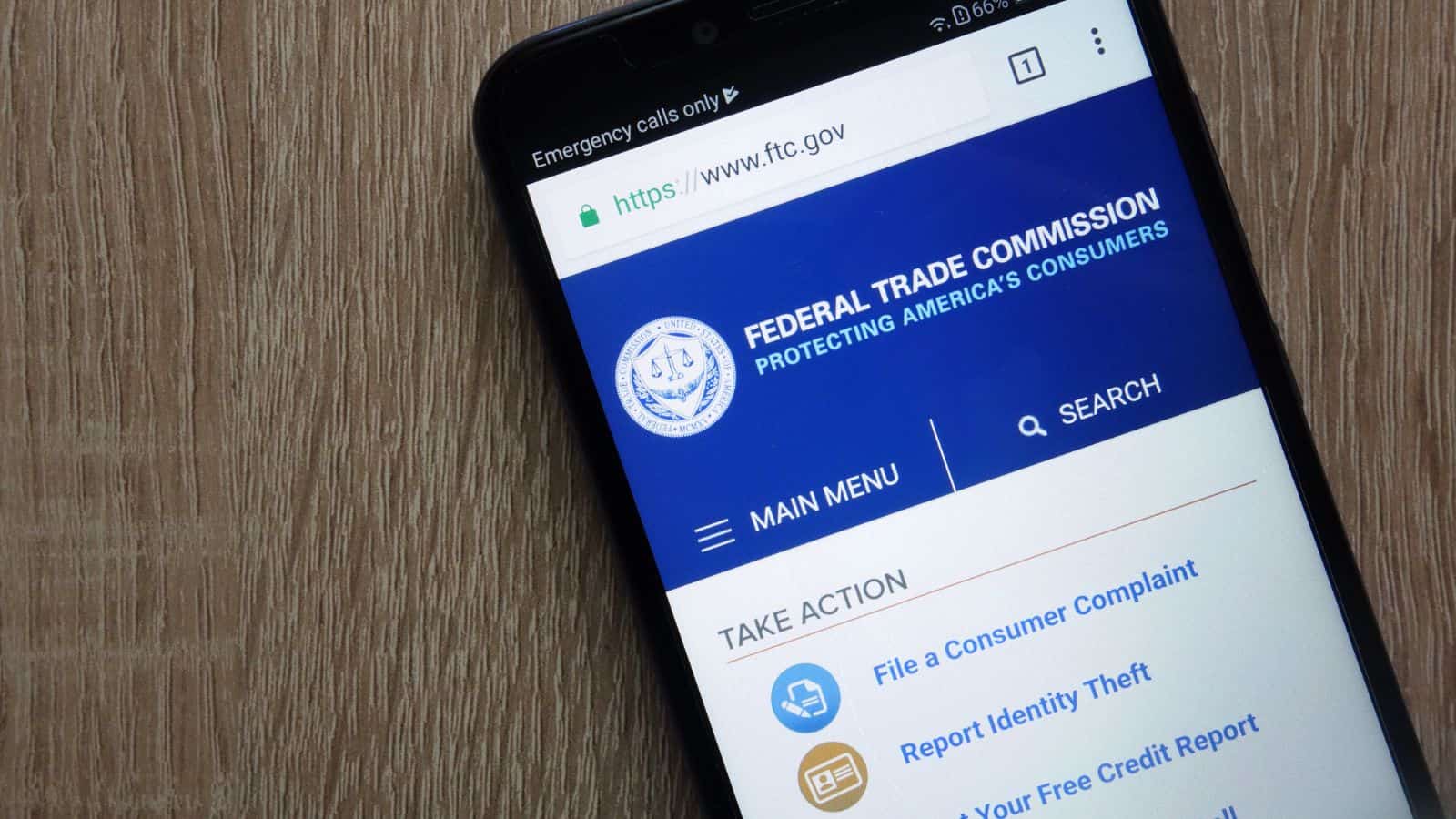

Contact the FTC

If your identity was truly stolen, you want to contact the Federal Trade Commission (FTC). They will ask you to create an Identity Theft Affidavit.

You don’t need an attorney for this. Simply follow the steps and you print if off.

File a Report With Your Local Police Department

You want to take the affidavit you printed to your local police department. They will use it to create an Identity Theft Report.

Make sure you bring a photo ID, and proof of where you live, such as a utility bill. The police will direct you of any next steps that might be necessary.

Be Vigilant

Having a stolen identity, or your credit card information stolen, is serious. Stay vigilant after it occurs to ensure you catch anything irregular.

Hopefully you won’t, but it’s essential to stay on guard to protect yourself and your finances.

How to Become Rich Quickly

Everyone wants to become rich quickly. While not always possible, there are legitimate ways to become wealthy. Follow these methods and you’ll be on the road to riches.

How to Become Rich in 9 Simple Steps

7 Ways to Make Mailbox Money

Mailbox money is a lot like passive income. You only need a little money to start to receive checks in your mailbox. Pursue these options to grow real wealth.

11 Best Passive Income Apps of 2023

Passive income is a great way to achieve your financial goals. Thankfully, there are apps that help you start and often with minimal resources. Get started today!

Signs You’re Financially Stable

Financial stability is the foundation to achieving financial freedom. Learn how financially stable you are and where you can improve.

33 Signs You’re Financially Stable

Why It’s So Hard to Make Ends Meet Today

Growing numbers of people are living on the edge in our culture today. Despite the growing economy, they’re being left behind. Here are 11 reasons why it’s so hard to make ends meet today.

11 Reasons Why it’s So Hard to Make Ends Meet Today

I’m John Schmoll, a former stockbroker, MBA-grad, published finance writer, and founder of Frugal Rules.

As a veteran of the financial services industry, I’ve worked as a mutual fund administrator, banker, and stockbroker and was Series 7 and 63-licensed, but I left all that behind in 2012 to help people learn how to manage their money.

My goal is to help you gain the knowledge you need to become financially independent with personally-tested financial tools and money-saving solutions.

Leave a Reply