Do you want to know how to invest in stocks, but don’t know where to start? This is a situation many beginning investors face and they allow their lack of knowledge to hold them back. I was the same way when trying to figure out how to begin investing in stocks. It was overwhelming, I didn’t have a lot of money, and I had no idea where to start.

This is a situation many face and use to put off investing. I heard that concern during my time as a stockbroker and regularly talk with investors today who simply don’t know where to start. This is a common feeling, so you shouldn’t feel alone.

If you’re facing a similar apprehension and want to know the best way to start, this post is for you.

I don’t necessarily blame investors for their ignorance. No matter what we know, there’s always more to learn when it comes to investing and, if you haven’t been fortunate to have a parent, relative or boss teach you how to invest in stocks, how would you know where to start?

If you’re wondering how to invest in stocks online for beginners, the below tips will give you everything you need to start building your wealth today.

Table of Contents

Start with Educating Yourself

The primary problem for many investors is a lack of comfort. Many peoples’ eyes glaze over when investing is mentioned, our society doesn’t champion it and our primary and secondary schools don’t teach it, so finding resources on how to learn to start investing is vital.

Many think they need to be experts to start investing in the stock market.

You don’t. You simply need to find the right resources to help you learn about investing. All it takes is a little knowledge and you can start investing with confidence.

The first two places I point investors to when they want to start investing is the following two books:

A Random Walk has been around for over 40 years and is considered by many to be the source to go to for investing education. The author, Burton Malkiel, breaks down many complex investing strategies and philosophies so simply that anyone can understand investing.

The second book is a collection of Warren Buffett’s annual letters organized thematically for simple reading. Buffett, as well, has a good style and talks in a way that makes investing easier for many to understand.

If you’re looking for other books on investing then make sure to check out our post on the best investing books for beginners for some other solid options.

Another good option for education is Stock Advisor from Motley Fool. Stock Advisor is run by brothers David and Tom Gardner, and is a service offered by Motley Fool since 2002.

Each month the brothers recommend two stocks they believe will outperform the stock market on a long-term basis. You don’t need to buy the stocks, of course, but the recommendations are well-researched and both brothers consistently beat the market.

Beyond the recommendations, Stock Advisor is a great tool to create watch lists, do research, and interact with other investors.

You can subscribe to Stock Advisor for $99 per year, or $19 per month if you prefer. Try their 30-day free trial to see if Stock Advisor is the right tool for your investment needs. This price is for new members only.

Finally, you can also check out some of the free investing tools I use to help with my investing needs.

What Stocks Should I Invest in?

This is a common question for many beginners who want to start investing. There are thousands of stocks to invest in, not to mention mutual funds and exchange-traded funds (ETFs).

Each of the three serve a different purpose, but can be a great way to start investing in the stock market for beginners. I’ll describe each below:

- Stock – represents a piece of ownership in a particular company and trades throughout the day on an Exchange like the New York Stock Exchange

- Mutual funds – are baskets, or groupings, of different stocks; each one is managed by a portfolio manager, but is not traded on an exchange

- ETFs – are a lot like mutual funds, but typically have cheaper fees; an ETF trades like a stock on a particular exchange

I like to follow the advice of Warren Buffett if you don’t know what to start investing in as a beginner.

Buffett says we should buy what we know. Explore your house and look at your daily habits. In many cases you’ll find that many of the products you buy are made by generally very solid companies who have been around for decades.

Beyond that, many of those companies typically pay dividends – which means they give money back to you, usually quarterly, for owning their stock. If you find yourself wanting to know how to invest in stocks, this is likely one of the easiest ways to determine which ones to consider.

How Much Do I Need to Start Investing?

I used to believe that you needed thousands of dollars to invest in the stock market. If you watch the news or CNBC you see people who are investing millions, or more, so it stands to reason that you need a lot of money to start – correct?

Wrong!

You can invest in the stock market with little money and do quite well. Few people have a lot of resources to start investing in stocks when they begin and waiting until you have thousands will only hurt you in the long run thanks to compound interest.

What is compound interest? In short, compound interest is when your money makes more money, or interest earning more interest. Compound interest is so powerful that Albert Einstein referred to it as the 8th wonder of the world.

To take advantage of compound interest you need to start investing as soon as possible. Time is the best gift you can give your investing, even if it’s in small amounts.

*Related: Do you want to invest in real estate but have limited funds? Check out our guide of the best crowdfunding real estate sites that let you invest with little money.*

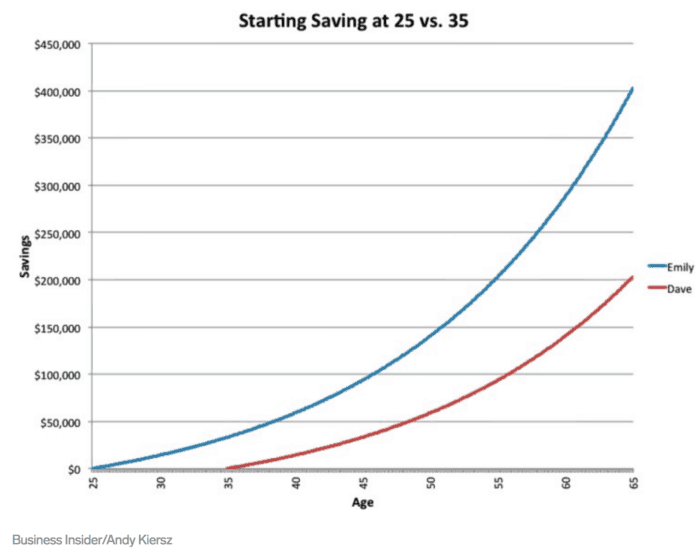

When it comes to saving for retirement, the Center for Retirement Research shows that if you start investing at age 25 you have to put away one third of what those who start at 45 do for retirement.

The moral of the story is to start investing in the stock market as soon as you can.The ultimate goal behind this is to grow your wealth.

Take a look at the chart below, courtesy of Business Insider, as an example example of the power of compound interest.

As you can see, the earlier you start, the less you actually have to save as it has more time to grow.

Not having enough should not be an excuse not to invest in stocks. If you need ideas of how to invest in stocks with little money, check out our guide on how to start investing with $500 or less on what you can do to start investing in the stock market.

Where Can I Open an Account?

If you want to know how to invest in stocks, you will need a brokerage account to do the investing. A 401(k) plan is the best way to start, but not everyone has access to a plan or others may want to invest more money.

In either case you will want to open an online brokerage account. There are many online brokerages to consider – here are the best online brokerages I’ve worked with. These brokerages will work for many investors, regardless of whether you’re a novice or an expert.

Remember how I mentioned you don’t need a lot of money to start investing in stocks? Many of the discount brokerages below will let you invest with little money.

- Acorns – no minimum deposit required

- M1 Finance – $0 minimum balance requirement and no fees to trade

- Stash – $0.01 minimum balance required

It is important to know that each of the above online brokers offer a more DIY approach to investing. Don’t fret. Many of them also have free tools, courses, and webinars to help you learn how to start investing in stocks.

Our favorite online brokerage is Betterment. Betterment is a robo-advisor and has no minimum balance requirement, and is the perfect option for newer investors.

If you’d rather get help managing your investments, you can even get that with little money. This is possible through something known as a robo-advisor. A robo-advisor manages the entire investing process for you.

You start by answering a few questions so they can learn about your goals, investing timeline, and appetite for risk. They take your answers and use them to construct an investment portfolio.

They manage your investments from there, ensuring it’s on target to reach your goals.

The beauty of the robo-advisor is they offer access to tools and management once only available to those with considerable money. This is a great resource for those just starting to invest in stocks.

If you want to know how to invest in stocks for dummies, there is no shortage of options to help you reach your investing goals.

Where is the Best Place to Start Investing?

Many people don’t realize that the best place to start investing in stocks is right in front of them – the 401(k) plan through their employer.

While you don’t typically get to invest in stocks in a 401(k) plan, you do get to invest in mutual funds and/or ETFs so you accomplish the same thing.

Why is a 401(k) the best place to start for beginners? It’s quite simple:

- You can start investing with no money

- You can set up automatic transfers from each paycheck

- Your employer may match what you contribute – that’s free money

- Many 401(k) plans offer free resources to help you learn about how to start investing in the stock market

Each 401(k) plan is different, but in most cases you can start investing in them when you start a new job. Some may make you wait several months. Just ask your employer when you start when you can begin investing in your 401(k).

If you find the plan overwhelming, check out our guide on how to set up your first 401(k).

How Often Should I Check on My Investments?

As you’re learning how to invest in stocks, you want to determine the goals you have for your investing. Is this the beginning of you saving for retirement or is this intended to start funding for children’s college education?

Whatever your goal is, you want to make sure you stay on top of it. There’s no set timeline you need to check in on your investments. Some like to check in each month while others space it out to check on them quarterly or annually.

Find what works best for you and do it religiously. One of the greatest investing mistakes many investors make is to set it and forget it with their investments and ignore them for years.

Far too often this leads to the investor losing significant money, not to mention risking that the investments are not in line with their current goals.

You want to make sure you know what exactly is going on with your investments. Ignoring them will not help you with this situation. Think of it like checking your bank account balance regularly.

Checking in on your investment accounts holds the same importance.

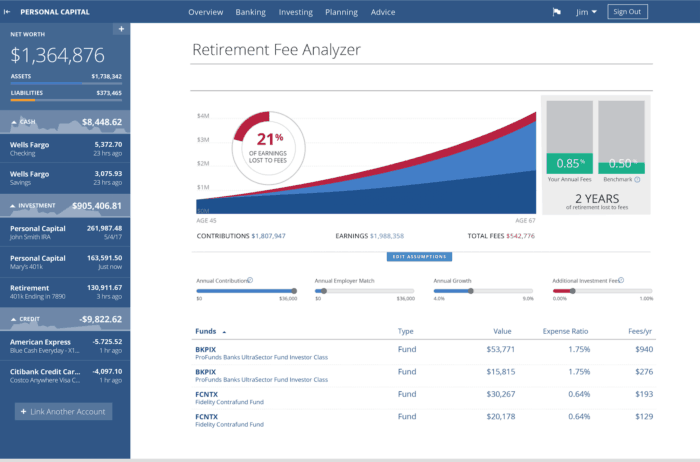

The best way I’ve found to monitor our investments is through the free tool at Personal Capital. Personal Capital offers many great resources, but one of the best ones is a free portfolio review.

They analyze how your investments are performing and look for lower fee alternatives.

As you can see in the picture below, Personal Capital even provides a dashboard that shows your net worth and displays a comparison between your investments and potential alternatives.

The best part is that this is all free of charge to use and they use government level security to ensure your information is secure.

Investing in stocks can take a lot of work. When you check in on your investments on a regular basis that removes a lot of the work for you.

Alternatives to Grow Your Wealth

Not everyone wants to invest in the stock market. Stocks brings a certain level of risk that some are not comfortable with taking. Some don’t trust the market and want another avenue to grow their money.

Does that mean that they’re out the opportunity to grow their wealth? No!

There are various other ways to grow your wealth outside of investing in stocks. Two of the best alternatives to stocks are peer-to-peer lending (P2P lending) and investing in real estate. Each carries their own risks and drawbacks, but both are great ways to build wealth outside the stock market.

LendingClub is the most well-known option to do P2P lending. With LendingClub you can invest in notes as low as $25. LendingClub rates borrowers so you can see the risk level of the borrower in question.

You can even open an IRA through LendingClub if you want to add P2P investments to your retirement planning. You do need at least $5,500 to open an IRA with LendingClub.

The LendingClub site claims returns of up to eight percent per year. This makes it competitive to investing in stocks, if P2P lending is something you’re comfortable with considering.

The other stock market alternative, real estate investing, carries with it misconceptions just like investing in stocks. Many think you need a lot of money to invest in real estate or that you need a lot of knowledge.

Until recently that has been the case, but thanks to crowdfunded real estate investing that is no longer true. You can invest in real estate in small amounts and not be responsible for managing individual properties.

Fundrise is one of the leading options to invest in real estate with little money. Fundrise allows you to start investing in real estate with as little as $10, in either a retirement or non-retirement account.

This allows you to pool your money with other investors and invest in commercial or residential properties. Fundrise also lets you invest based on your specific goals so you invest in a fund that more closely meets your needs.

RealtyMogul is another good option to invest in real estate. You need to have $1,000 to start, but has lower fees than Fundrise.

Summary

It’s challenging to know how to invest in stocks when you don’t know where to start. The terminology is confusing and the number of choices can be overwhelming.

That doesn’t even begin to consider how much money you need to invest or concerns you may have about risk.

There are many reasons not to invest in stocks, but most often they have no merit. If you’re asking yourself “should I invest in the stock market?”, you’ve already answered the question incorrectly.

The real question should be “what am I missing out on by not investing in the stock market?”

The answer to that question reveals the whole reason why you need to start. The stock market is one of the best ways to grow your wealth today, if not the best way.

Yes, the stock market is full of risk. Yes, you will lose money, however you will also make money. Most things in life worth anything are full of risk and leave you open to loss.

The reason why you need to invest in stocks is that it will help you reach the goals you have in life. The goal really doesn’t matter, it can be one of the reasons below:

- To be able to retire when you want

- To create a passive income stream

- To help your young child pay for college

- To someday be able to buy a house

- To provide for your family upon your passing

These are just a few of the reasons why it’s important to invest in the stock market as soon as possible. If you’re figuring out how to invest in stocks as a beginner, take advantage of the free resources in this post, those available through your 401(k) plan and/or online brokerage, and those offered online.

There’s a wealth of free information available that will set you on the right path to start investing in stocks today and begin to grow your wealth.

Are you trying to figure out how to invest in stocks? If not, how did you start investing? What are other alternatives to the stock market you’d consider as an investment possibility?

I’m John Schmoll, a former stockbroker, MBA-grad, published finance writer, and founder of Frugal Rules.

As a veteran of the financial services industry, I’ve worked as a mutual fund administrator, banker, and stockbroker and was Series 7 and 63-licensed, but I left all that behind in 2012 to help people learn how to manage their money.

My goal is to help you gain the knowledge you need to become financially independent with personally-tested financial tools and money-saving solutions.