This is a sponsored post written by me on behalf of TransUnion. The opinions and text are all mine.

Many people struggle with their finances. In the past, I was one of them.

During college, I was baited by free merchandise and ensnared with promises of easy money from a quick application process.

After that, the sky was the limit. Anything I wanted and didn’t have the cash for could be mine simply by pulling out that cool piece of plastic. By the time I finished college, I had $25,000 in credit card debt from bad financial choices.

My out of control spending left me with suffocating debt I didn’t know how to get out from under. Creditors were calling day and night and I didn’t know what to do. I thought about declaring bankruptcy, but there were fees involved and I didn’t have the money to pay for them.

That’s the day I changed my thinking about money.

Instead of giving up, I started looking for alternatives to bankruptcy and paid off what I owed, bit by bit. I did everything I could to save money, make money, and pay off debt responsibly.

Eventually, I was able to get out of debt and better manage my credit score. If you are also struggling financially, you can get rid of debt and manage your credit score as well. Here’s how I did it and how you can do it too.

Table of Contents

Change Your Thinking

First, I had to change my thinking about money if I was ever going to get out of debt. At my darkest hour, I finally realized that all the spending and stuff I bought hadn’t made me any happier.

In fact, it made me miserable because of the mountain of debt I owed for it.

Instead of using money to buy stuff to make me happy, I started using it as a tool to get the kind of life I really wanted. I made smarter choices and bought wisely. I used money to get rid of debt rather than creating it.

Talk to Creditors

When I was paying off debt I didn’t have to call my creditors because they were already calling me. Still, you may have to call some, or all, of them to let them know your financial situation.

When you call, you’ll find that some will work with you. They may even lower your interest rates or payments until you can get the cards paid off.

Although that may sound surprising, it makes sense if you think about it. Working with you is in their best interests because they would rather have some money than no money at all.

Make a Budget and Pay Off Debt

If you’re trying to get rid of debt, you should make a bare bones budget. You’ll want to include only the necessities. Make the hard choices and slash your spending.

If it isn’t a basic necessity, like rent, food, water, electricity, insurance, etc. it needs to be eliminated. Read our review of how to create a budget if you don’t know where to start.

After you’ve done that, the rest of your money should go toward paying off debt.

Stop Buying on Credit

What I did to get rid of credit card debt was somewhat drastic. I cut up my credit cards so I couldn’t use them anymore. Does this mean you will never use credit cards again? Not necessarily.

*Related: Do you need to improve your credit? Read our review of the best credit repair services to fix your credit.*

Once you get your debt under control, you can learn to use credit cards wisely for items you can pay off at the end of the month. But while you’re working to get rid of debt you need to eliminate the temptation to use plastic. That may mean cutting up your credit cards.

I’ve heard of others who have frozen them in blocks of ice or put them in a locked file cabinet. How you handle your credit cards is up to you. Do whatever is necessary for you to stop buying on credit. Otherwise, you’ll be right back where you started.

Manage Your Credit Score

When you’re deep in debt, there’s a good possibility your credit score has suffered. But it still helps to know what it is. Then you can start rebuilding both your credit score and your finances.

What is a Credit Score?

Your credit score reflects your payment history and whether or not you are a good credit risk. Whenever you apply for a credit card, or any other type of credit, your credit score and credit report will likely be reviewed.

Good scores tell lenders that you are a good credit risk.

Your credit history comes from past information that previous creditors have provided. If you are not good about paying your bills on time or use too much of your credit, your score will be lower.

If some bills have gone to collections, your credit score could be even worse.

It’s important not to be in the dark about your credit. Information is power. You can use the resources at both TransUnion and Experian to find out your score and view what may be impacting it.

Why Does it Matter?

The reason it’s important to manage your credit score is for future credit needs. While it may not seem important now, it might be in the future. With a low score, you may not be able to get a car or home loan when it’s needed.

Not only that, many others are able to access your credit, such as:

- Potential employers

- Landlords

- Utility providers

- Insurance companies

This can mean increased rates, or even not getting a job or apartment because of your credit. Thankfully, this can be improved.

If you get rid of debt, your score will most likely rise, which means you will have better purchasing power in the future and less fear of the unknown.

How Can I Rebuild it?

When rebuilding your credit, you will need to make wise decisions about using credit cards. Pay off all balances monthly and monitor your accounts for fraudulent activity.

Any loans you take out should be of a manageable amount and duration. Try never to use more than 30 percent of your available credit. That will help you build your credit.

How Can I Manage it Better?

Another way you can manage your credit score better is to ensure that your personal information is protected. You could have a low credit score because of factors outside of your control.

For example, thieves can steal your identity, run up debt, and lower your score.

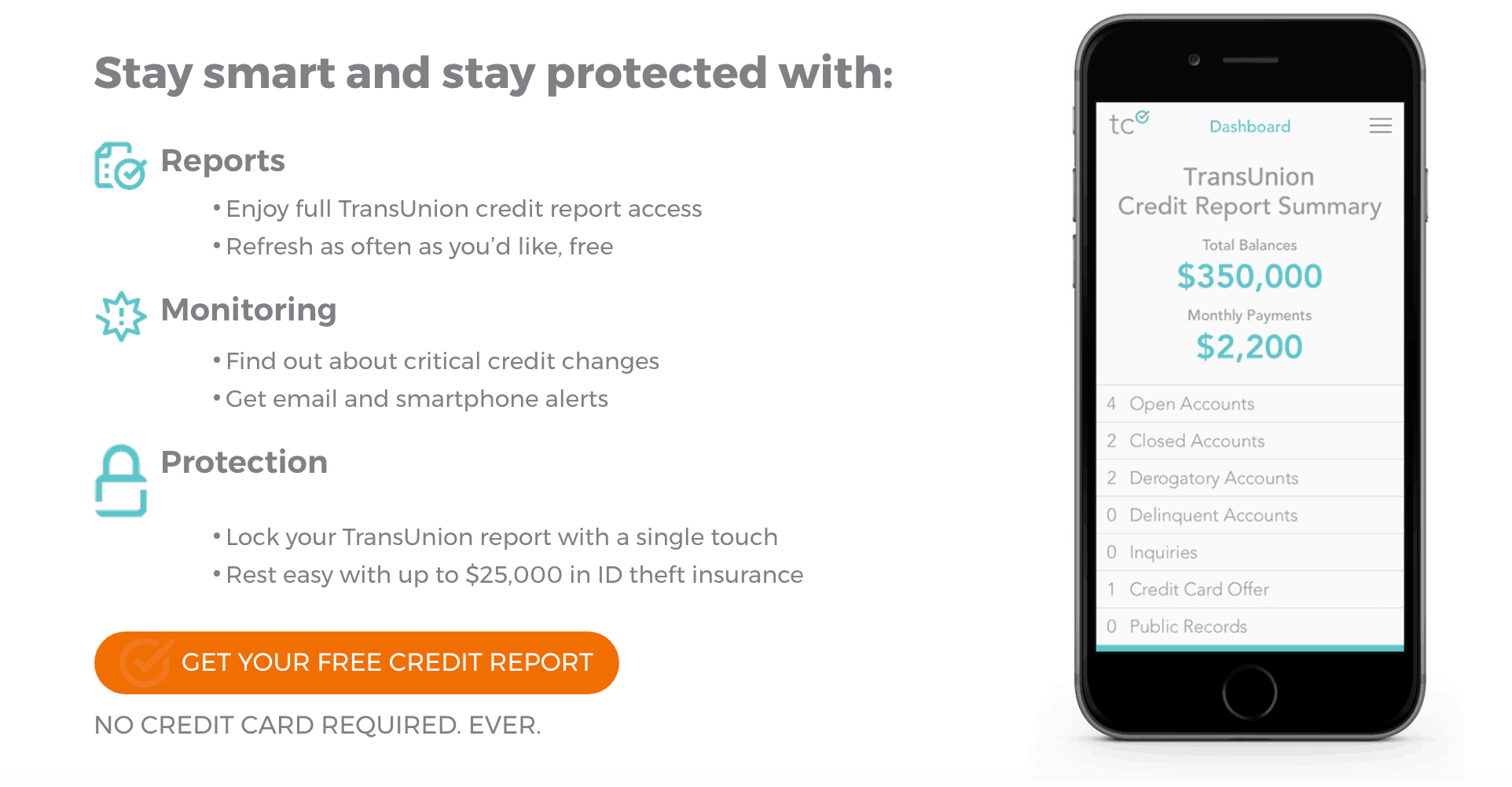

Luckily, there are tools that can help you monitor your credit for fraud. TransUnion offers TrueIdentity to protect your information and your credit score for free.

In addition, they have lots of tips and resources that can further educate you in protecting your information. That way, your credit score will be your own rather than a reflection of someone else’s criminal actions.

TransUnion offer several products such as TransUnion Credit Monitoring with Credit Lock Plus. These products and tools will empower and assist you with managing your personal information.

Bottom Line

Getting out of debt takes time and patience. There are no quick fixes. But it doesn’t have to be hard. Use the tools, tips, and resources mentioned here to help you on your way. Before you know it, you’ll be rid of debt and have a better credit score.

I’m John Schmoll, a former stockbroker, MBA-grad, published finance writer, and founder of Frugal Rules.

As a veteran of the financial services industry, I’ve worked as a mutual fund administrator, banker, and stockbroker and was Series 7 and 63-licensed, but I left all that behind in 2012 to help people learn how to manage their money.

My goal is to help you gain the knowledge you need to become financially independent with personally-tested financial tools and money-saving solutions.

Leave a Reply