Your health is an important thing to watch over. If it declines, you can pay for it for years and reduce your level of enjoyment in life. This may be particularly true of frugal people who try to avoid spending money, despite their best interests. In a recent discussion in an online forum, people shared mistakes budget-savvy people make with their health. Here are 12 of their most common responses.

Table of Contents

1. Ignoring Essential Health Check-ups

Life can get busy, and sometimes we put off things that should be a top priority. When it comes to your health, skipping those important check-ups is unwise. Overlooking medical appointments is a big no-no, if not for any other reason than you’ll spend way more on treating something that could have been prevented.

2. Not Investing in Good Mattresses

Uncomfortable mattresses and bedding can mean poor sleep, and lack of quality sleep can make you cranky and unable to concentrate. The effects of chronic sleep deprivation extend beyond just feeling tired.

Research has shown that prolonged sleep deficiency is associated with dementia, heart disease, diabetes, and obesity. Additionally, it can compromise your immune system, contribute to depression and stress, and even cause pain.

3. Using Low-Quality Footwear

Ever heard the saying, “Don’t cheap out on anything that goes between you and the floor”? That includes chairs, beds, and especially shoes. Sacrificing your comfort and health for a few extra bucks isn’t worth it. One person writes, “The shoe thing is so crucial.” They learned the hard way, ending up with “tendinitis in both feet, directly affecting my quality of life for years” due to skimping on shoes. They wouldn’t mind spending that extra $100 now.

4. Trying Risky DIY Projects

Attempting risky tasks without proper training or strength can lead to disaster. Take electrical work, for instance. Many people try to save a buck by doing electrical work without experience.

Sure, some DIY can work for minor tasks if you’re confident. However, a failure can have catastrophic consequences regarding major tasks. Hire a licensed, insured professional for the big stuff. And remember to ask for proof of insurance!

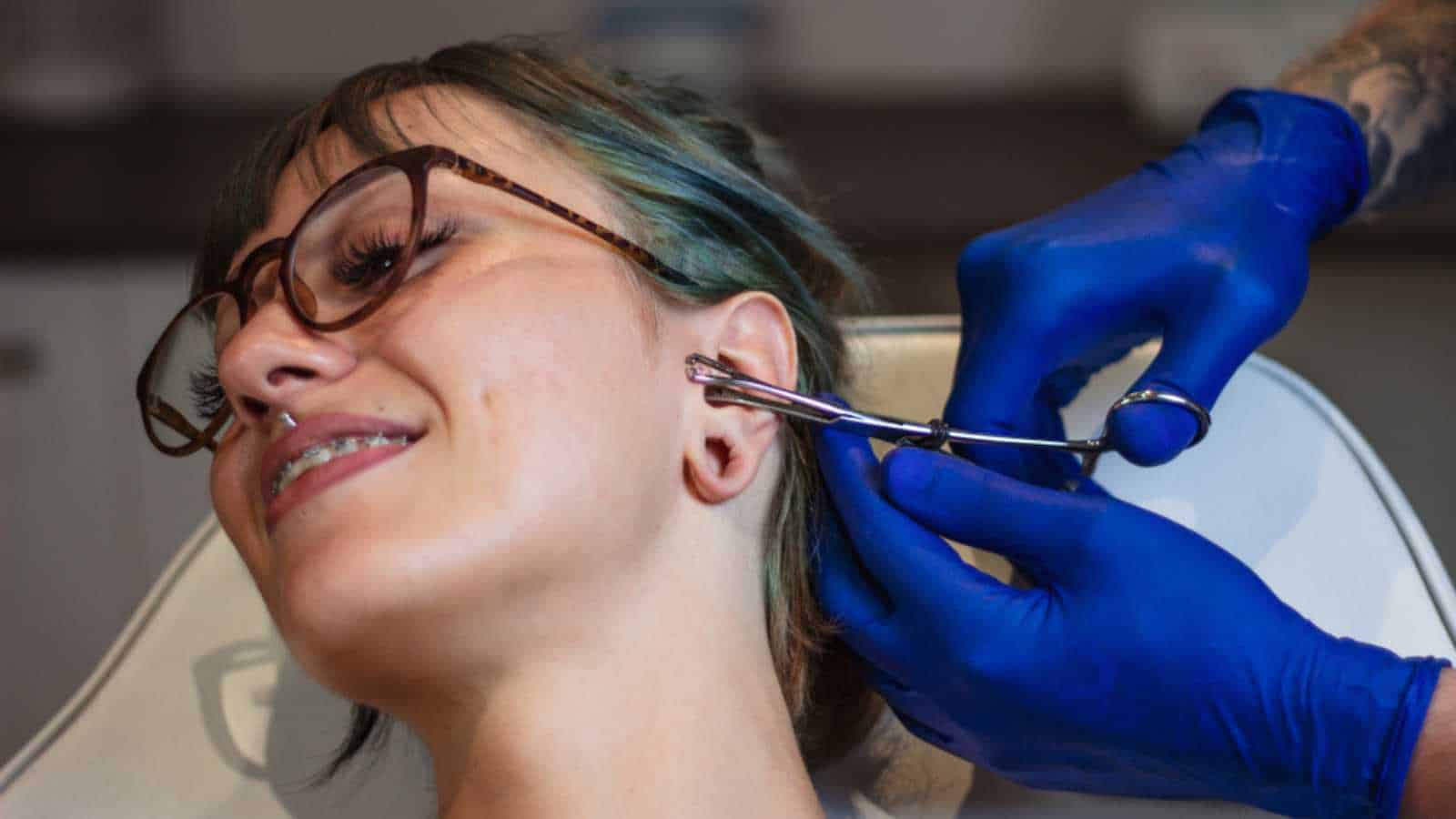

5. Bargain Piercings Aren’t Worth It

If you’re a piercing enthusiast, avoid places that compromise safety for savings. Research shows poorly done piercings can lead to nasty infections — not worth the few bucks saved.

Opt for a professional; their prices are slightly higher than jewelry at “budget” parlors. Their “free piercings, just buy the jewelry” deal? It’s clever marketing, but it’s not worth the risk.

6. Not Taking Preventive Measures

Prevention is always better than cure. Think about it — taking preventive measures like maintaining your oral hygiene with regular brushing, flossing, and mouthwash is way more affordable than dealing with hefty dental bills later on.

After an eye exam, consider checking out online vendors. They’re a budget-friendly option cheaper than a traditional optometrist visit. Also, don’t underestimate the power of routine blood work and simple exercises like walking. These small steps can go a long way to prevent potential health issues.

7. Eating Cheap Junk Food

This phrase holds a ton of truth with your diet. Think of food as your ultimate preventive medicine. We’re not saying eating healthy will grant you immunity from every ailment.

However, chowing down on junk food sets you up for a parade of health issues. Opting for a nutritious diet isn’t just a fad; it’s a powerful choice to improve your well-being.

8. Neglecting Self Care

Recognizing when to treat yourself and your loved ones is essential. Even if you’re a reigning frugality champion, there’s a point where trying to handle everything solo can leave you drained and burnt out. Sure, saving and investing are crucial steps toward financial security.

But a life well-lived is sprinkled with little luxuries. A fulfilling life involves savoring a fancy dinner out or indulging in a well-deserved getaway now and then. There has to be a balance of frugality/saving and then spending.

9. Not Comparing All Facets of a Health Plan

It’s a known fact that health plans can be extremely expensive. A good, frugal person may be tempted to choose the least expensive plan.

On the surface, that may seem harmless. However, it’s essential to compare all factors in each plan. While you may not need the most expensive plan, the second most affordable plan may offer some perks that make it a better deal for you in the long run.

When in doubt, don’t be afraid to ask your Group Benefits area questions to narrow down your choice,

10. Not Paying for a Gym Membership

Lighter workout sessions are okay if your goal is simply to boost your health. If you’re all about bulking up or tackling intricate routines, that’s when the game changes. Attempting complex workouts sans professional guidance is risky business.

Having an instructor or rubbing shoulders with experienced lifters is like having a GPS for your workout. Trying intense routines solo could lead to muscle tears or joint mishaps.

11. Skipping Breakfast

Skipping meals isn’t exclusive to the frugal folk. We get it. But sometimes, trying to save money leads to skipping meals. And guess which meal often gets the snub? Unfortunately, today’s hustle and bustle has faded the breakfast tradition into the background.

People don’t realize skipping breakfast is like taking a road trip without filling the gas tank. No breakfast equals a sluggish engine and a drop in productivity and can invite chronic diseases like diabetes and obesity. Over time, your memory and heart could be dealt a not-so-favorable hand.

12. Living in Borderline Dangerous Conditions

Finding an affordable apartment is undoubtedly a victory, but with rent prices soaring, there’s often a catch. If you’re paying peanuts, chances are you’re waving goodbye to something significant.

Consider this real talk: “I live in such a bad area right now, but my rent is so cheap. Crime is so high, though, that I’m always on alert. I can’t go outside at night, and it’s loud and trashy,” one individual shares. Your safety and well-being are the VIPs of the show. Sacrificing your peace and happiness to save a few bucks on rent isn’t a fair trade-off.

35 Proven Ways to Save Money Every Month

Many people believe it’s impossible to save money. Or, they think saving $20 or $50 a month won’t amount to much. Both are incorrect. There are many simple money-saving tips that can add up to big savings. You just have to start one, then another, to increase your savings.

Ways to Save Money Every Month

21 Awesome Passive Income Ideas

Passive income is an excellent way to build wealth. Thankfully, many ideas only require a little money to start. Pursue these options to grow real wealth.

Best Passive Income Ideas to Build Real Wealth

7 Best Cheap Meal Kit Delivery Services

Not all meal kit delivery companies are expensive. Some are relatively affordable and cheaper than dining out. Plus, they can save you time in the kitchen. That’s a win-win.

7 Best Cheap Meal Delivery Kits

How to Save Money on a Tight Budget

Saving money feels impossible when you’re struggling to make ends meet, but you can do it. Use these tips to save money each month, even on a tight budget.

How to Save Money on a Tight Budget

How to Build an Emergency Fund

Having a fully-funded emergency fund is the gold standard of personal finance. However, it’s not always easy to achieve. Follow these steps to start and grow one that gives you peace of mind.

How to Build an Emergency Fund

This thread inspired this post.

I’m John Schmoll, a former stockbroker, MBA-grad, published finance writer, and founder of Frugal Rules.

As a veteran of the financial services industry, I’ve worked as a mutual fund administrator, banker, and stockbroker and was Series 7 and 63-licensed, but I left all that behind in 2012 to help people learn how to manage their money.

My goal is to help you gain the knowledge you need to become financially independent with personally-tested financial tools and money-saving solutions.

Leave a Reply