Congratulations, you’re done with school! Living on a student budget in college does little to prepare you for life post-graduation. With your first professional job, you likely have more money and dozens of ways to spend it.

While overwhelming, following a few simple money tips will help you pad your bank account, pay bills, and avoid debt. This guide shares a helpful budget worksheet for new college graduates to master their finances.

Table of Contents

What Is a Good Budget Worksheet for Recent College Graduates?

Following a simple budget template is critical when you’re new to managing your cash. You must balance new-found liabilities like student loans while trying to save for retirement.

Don’t let this new burden lull you to inaction. Instead, following the simple 50/30/20 rule to budgeting is a fantastic way to balance your monthly budget.

Here’s how it works:

- Spend 50 percent on your needs, such as monthly rent, groceries, and debt repayment

- Spend 30 percent on items you want, like travel and other entertainment

- Spend 20 percent on saving and additional payments on debt

Don’t feel bound to this guideline since your situation might be different. Personal finance is personal, so adjust these parameters to your specific budget categories and savings goals.

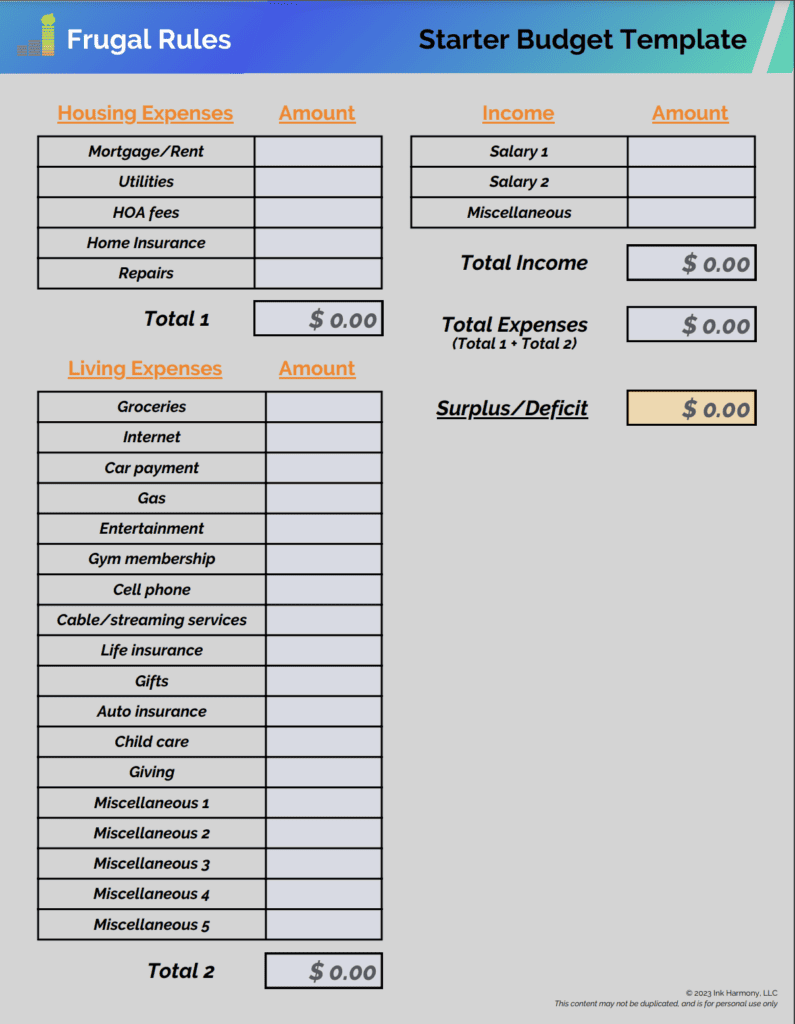

You can use our sample printable budget worksheet below to start a basic plan. Input your monthly income in the “Salary 1” field.

If you have a partner, put their salary information in the “Salary 2” field. Any income you earn on the side should go in the “Miscellaneous” section.

Then, fill out the expense fields with the costs that apply to you. After you supply all of the information, you should see a surplus or deficit line on the bottom right of the spreadsheet.

Download Our Free Starter Budget Template NowKnow Your Priorities

It’s impossible to attack every goal at once. Part of budgeting 101 is analyzing your goals and determining their priority level.

Here are some common targets you should have to achieve financial stability:

- Actively work to save at least $1,000 in your emergency fund.

- Start saving for retirement through the 401(k) account available at your job, and save enough to receive the match. If you don’t have access to a 401(k), open an IRA.

- Pay off non-student loan debt and avoid credit card debt.

- Build your savings account to have at least three months of living expenses.

Budgeting apps like You Need A Budget (YNAB) can be a helpful resource for new grads to think through these priorities. They help you analyze your spending and align your expenses with your financial goals.

This is of particular importance if your parents are helping you financially. A recent Bankrate study reveals nearly 70 percent of parents of adult children are making financial sacrifices to aid their children.

If you’re receiving assistance from your parents, and you want that to stop, identifying your priorities is essential.

Determine Your Income

Income is one-half of your budget. Increasing your earnings is good for your checking account and helps you manage your expenses more easily.

Don’t hesitate to pursue multiple sources of income to help stabilize your finances. This includes taking on additional duties at your day job or pursuing a side hustle.

Side hustle apps let you identify online opportunities or gigs in your area. Find one that works with your schedule, then use the earnings to start saving money and kill any outstanding debt.

The more you work to make money, the better sheltered you are from wild swings in your finances.

Assess Your Expenses

When looking at any budget worksheet for new college graduates, you will see two types of common expenses. These include fixed and variable.

Fixed expenses are as they sound. They are the same amount every month. Variable expenses vary from month to month. Regardless of the expense type, spending less allows you to focus resources on other priorities.

Here’s how to plan for each.

Fixed Expenses

Fixed expenses are often the largest responsibility you have. Common fixed household expenses include:

- Monthly rent

- Renters insurance

- Car payments

- Life insurance premiums

- Auto insurance premiums

You may also have student loan payments that are fixed. It’s best to look for ways to save money each month on these expenses.

For example, you can compare multiple insurers to get the best rate for car insurance. Living with a roommate is another fantastic way to lower living expenses. Additionally, try to avoid an expensive car loan.

Variable Expenses

Variable expenses can make or break a budget for new college graduates. They symbolize the daily spending choices you make.

Common variable expenses include:

- Groceries

- Entertainment

- Hobbies

- Dining out

- Personal expenses

- Clothing

- Utilities

- Gas

It’s best to use free budget apps to help you monitor these expenses. Making poor choices may result in living paycheck-to-paycheck and impede your goals.

Life is about having balance, so don’t eliminate fun entirely. Actively look for ways to save money every month on these costs so you can have what you want for less.

It’s Time to Attack Debt

Debt is restrictive, especially if it comes with high interest rates. Getting rid of it is key in any budget worksheet for recent college graduates.

If you have student loan payments, it’s possible you may qualify for an income-based repayment plan. Take advantage of that if necessary while you get on your feet.

When you have credit card debt, that is of utmost priority. The interest alone can make it difficult to repay quickly. Apply whatever you can to your credit cards to knock down the principal fast and avoid late fees.

Furthermore, avoid the temptation of an expensive car payment. This will erode any efforts to repay debt.

Read our guide on how to pay off debt fast to identify additional budgeting tips to achieve financial freedom sooner.

It’s Time to Save For the Future

While it may seem too far off, saving for retirement is an essential part of any budgeting worksheet for new college graduates. Time is the best gift you can give your money, so start saving as soon as possible.

Taking advantage of your employer-sponsored 401(k) is critical. Deposits come right out of your paycheck and go into your chosen investments. Your employer may even match part of your contribution.

If your employer doesn’t offer a 401(k) or you want to supplement it, an IRA is a good solution. Investing can be overwhelming, but don’t let that hold you back if you’re new to the stock market.

M1 Finance is a helpful resource to use for new investors. The platform has no minimum balance requirements. It also offers self-directed and assisted investing options.

Read our guide on a penny doubled for 30 days to learn the importance of starting early and the power of compound interest.

Build Your Credit

A good credit score is vital for many things you want in life. It impacts everything from an interest rate on a new mortgage to your ability to rent an apartment.

This score is what banks and other institutions look at to assess the risk of you not repaying debt. Having a lower score results in higher interest rates.

A credit score is comprised of five main components. These include:

- Payment history = 35 percent

- Amounts owed = 30 percent

- Length of credit history = 15 percent

- New credit = ten percent

- Credit mix = ten percent

Having a good credit history and keeping the amount you owe low will put you in the best position possible.

You can monitor your credit score for free with Credit Karma. In addition to tracking your score, you can receive tips to boost your score.

Grow Your Savings

Spending less and saving your salary increases lets you plan for upcoming bills. To avoid accidentally spending your cash, try scheduling an automatic transfer into an interest-bearing savings account.

CIT Bank is a terrific choice to grow your savings and avoid bank fees. You also have instant access to your cash for surprise bills.

For money you don’t need in the next few years, consider investing some of your spare cash to build long-term wealth.

Monitor Your Finances Regularly

Managing your budget worksheet is not a one-time event. You want to revisit it regularly to determine where you stand.

How often you review your finances depends on your situation, but it’s best to look at your budgeting spreadsheet monthly when you begin. You may find that moving to quarterly or semi-annual is sufficient as time goes on.

Streamlining your spending is key to the optimal use of your money. If you’re overspending in one area, look for ways to reduce costs or move funds to cover the overage.

Furthermore, if you’re spending less in one area, apply the deficit to other areas that need it or put the money in your savings account. With a few tweaks, you can improve your finances and achieve your goals quicker.

Read our guide on how to create a budget to learn more.

Summary

Managing your money after graduating does not have to be difficult. This budget worksheet for new college graduates can set you up for success and let you use money as a tool to get what you want in life.

It’s ok to make mistakes. We all have to start somewhere. With a little effort and time, you can optimize your finances to live the life you want.

What is one area you struggle with when managing your finances?

I’m John Schmoll, a former stockbroker, MBA-grad, published finance writer, and founder of Frugal Rules.

As a veteran of the financial services industry, I’ve worked as a mutual fund administrator, banker, and stockbroker and was Series 7 and 63-licensed, but I left all that behind in 2012 to help people learn how to manage their money.

My goal is to help you gain the knowledge you need to become financially independent with personally-tested financial tools and money-saving solutions.