Investing is a key way to grow your money and achieve your financial goals. However, many people avoid investing because they lack the time or skill. Fortunately, platforms like Betterment help make investing easy for anyone.

Betterment is a robo-advisor that can manage your portfolio at a minimal cost. In fact, the platform lets you start investing with $0. With Betterment, you don’t trade individual stocks or mutual funds that can be risky and have high fees.

Instead, you invest in a bucket of Exchange Traded Funds (ETFs) index funds that fit your specific goals.

Table of Contents

What is Betterment?

Betterment launched in 2008 and is the most established player in the robo-advisor space. Today, the advisor manages over $21 billion in assets and has 500,000+ clients.

You can open taxable, traditional individual retirement accounts (IRAs) and Roth IRAs.

A decade ago, investors had to pay a hefty fee for managed portfolios. The “free” option was (and continues to be) investing on your own.

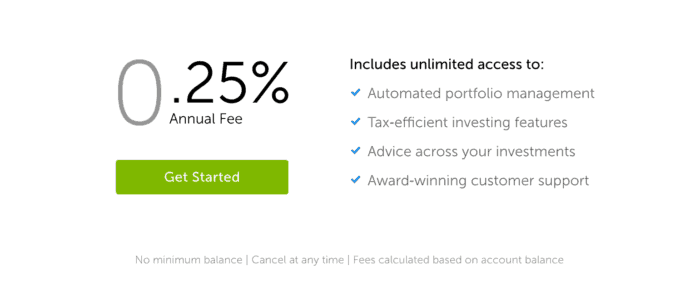

Betterment can manage your portfolio for less than a traditional advisor. While most advisors charge at least one percent, the Betterment annual advisory fee is only 0.25 percent.

You can keep your investing fees and portfolio risk low by investing with passive index funds. When you pay fewer fees, you’ll have more cash to invest.

Betterment also offers these additional features:

- Access to financial advisors

- Fee-free checking accounts

- Interest-bearing cash management accounts

If you’re looking for other features, read our guide on the top Betterment alternatives to find a suitable option.

How Betterment Works

Betterment invests in multiple US and foreign stock and bond asset classes using index fund exchange-traded funds (ETFs). Index funds have low fees so you can invest more cash and have instant diversification.

One of the main reasons to use Betterment is that it has fully-automated portfolios. You can invest in stock and bond index ETFs that fit your age and investing goals, including:

- Retirement

- General investing (i.e., generate passive income)

- Saving for a major purchase

- Building a cash safety net

Betterment will recommend different stock and bond asset allocations for each of your goals. For example, you will mostly invest in stocks if you have several decades until retirement.

Alternately, your cash safety net will hold more bond funds than stock funds since they are less risky.

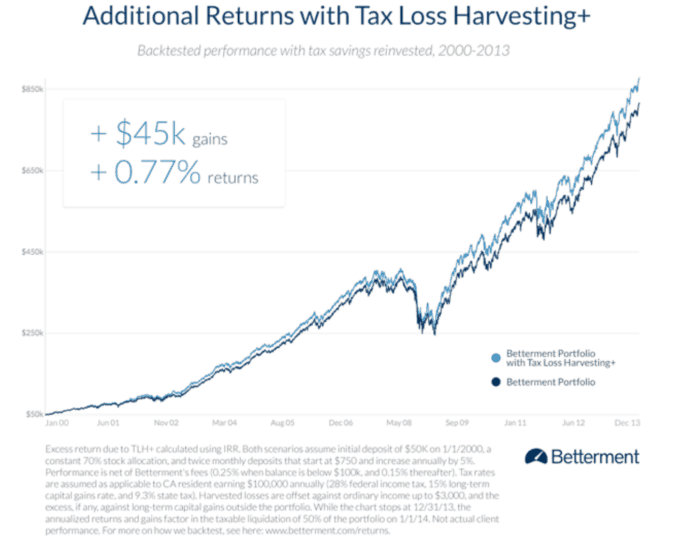

As you invest new cash, your portfolio is automatically rebalanced. Free tax-loss harvesting comes with every account to help reduce your taxable income. These perks remove some of the hassles that come with investing.

You can open multiple accounts with different goals. These accounts can help you plan for short-term and long-term goals.

Betterment at a Glance

| Info | Data |

|---|---|

| Minimum Investment | ✓ $0 |

| Account Types | ✓ Retirement | Trusts | Taxable | Joint |

| Management Fee | ✓ 0.25% / yr. (0.4% for $100K) |

| Features | ✓ 401(k) assistance |

| ✓ Tax loss harvesting | |

| ✓ Portfolio rebalancing | |

| ✓ Auto deposits (weekly, bi-weekly, monthly) | |

| ✓ Advice from real humans | |

| ✓ Socially responsible investing | |

| ✓ Fractional shares | |

| ✓ Cust. Svc.: Phone, live chat, email | |

| Get Started | Sign Up Now |

If you’re a new investor, this hands-on approach helps you avoid common investing mistakes.

How to Open an Account

Here’s a step-by-step at what it looks like to open an account with Betterment.

1. Choose a Taxable or Retirement Account

First, you will enter your email address and personal tax details. Then, you decide if you want to open a taxable account or an IRA.

2. Take an Investor Quiz

The next step is completing the investor quiz. In 15 minutes or less, you’ll answer several questions about your investing goals.

Once you finish the quiz, you will see your personal investment plan. Your plan will list which ETFs are viable investment opportunities for you.

3. Fund Your Account

The final step is funding your investment account from a linked bank account. It takes up to two days to transfers funds. Betterment invests the cash as soon as it arrives in your account.

There are no trade commissions to buy or sell funds. You can invest as little as $10 at a time. Since Betterment buys fractional ETF shares, you won’t have idle cash sitting in your investment account.

Setting up recurring deposits lets you invest regularly. Additionally, Betterment rebalances your asset allocation with each new investment.

Investment Philosophy

Betterment uses an approach that is similar to the buy-and-hold investing strategy. The app focuses on your long-term goals as opposed to trading individual stocks.

This goals-based strategy allows you to invest in US as well as foreign stock and bond index ETFs.

These are some of the stock index ETFs you can invest in:

- VTI – Vanguard Total Stock Market ETF

- VTV – Vanguard US Large-Cap Value Index ETF

- VOE – Vanguard US Mid-Cap Value Index ETF

- VBR – Vanguard US Small-Cap Value Index ETF

- VEA – Vanguard Europe Pacific (EAFE) ETF

- VWO – Vanguard Emerging Markets ETF

You can also invest in these bond index funds:

- SHV – iShares Short-Term Treasury Bond Index ETF

- VTIP – Vanguard Short-term Inflation-Protected Treasury Bond Index ET

- BND – Vanguard US Total Bond Market Index ETF

- MUB – iShares National AMT-Free Muni Bond Index ETF

- LQD – iShares Corporate Bond Index ETF

- BNDX – Vanguard Total International Bond Index ETF

- VWOB – Vanguard Emerging Markets Government Bond Index ETF

Betterment lets you invest in most areas of the stock market. It also allows you to limit your downside risk since the best assets can change from year to year.

Younger investors with a higher risk tolerance will mostly invest in stock funds. For example, you may hold 90 percent in stock funds and ten percent in bond funds at age 20.

As you near retirement, you might only have 60 percent in stocks. The Betterment auto-adjust tool buys more bonds and fewer stocks as you age.

Advanced Investing Strategies

Betterment gives you access to advanced investing strategies that can help you achieve your goals. Like the core portfolios, these plans only invest in ETFs. However, these options may not beat the overall stock market.

Socially Responsible Investing

Index funds are an effortless way to earn passive income, but some funds may invest in companies that don’t align with your values. This is why socially responsible investing (SRI) is a growing trend.

When possible, Betterment avoids funds with poor environmental, social, or corporate governance scores.

Goldman Sachs Smart Beta

The Goldman Sachs Smart Beta plan is for investors with a higher risk tolerance. While this strategy is Betterment’s most aggressive strategy, it strives to keep volatility low.

You can invest in alternative assets like real estate with Smart Beta. Keep in mind that real estate index funds may perform differently than stocks and bonds.

BlackRock Target Income

The BlackRock Target Income portfolio only invests in bonds. This low-risk option can be ideal for retirees wanting a fixed income.

Account Types

It’s possible to have taxable and retirement accounts with Betterment, including:

- Single taxable accounts

- Joint taxable accounts

- Traditional IRAs

- Roth IRAs

- Rollover IRAs

- SEP IRAs

- Inherited IRAs

- Trust IRAs

It is free to open taxable and retirement accounts with Betterment. Other online brokers may require a $500 balance to open an IRA, but Betterment doesn’t require an initial deposit to open an account.

Read our analysis of ways to invest $500 or less to identify those options.

Having multiple accounts unlocks tax-coordinated investing. This perk improves your tax-efficiency and keeps your tax liability low.

Additional Features

Betterment offers several exciting features to help plan for your short-term and long-term goals. You can also open bank accounts for investing and saving.

Retirement

Most people invest to save for retirement but have a hard time planning for their golden years. Betterment’s tools make retirement planning easier.

Retirement Income: This tool projects your monthly retirement spending. You can schedule auto-withdrawals to avoid outliving your savings. Decumulation during retirement can be tricky to balance, but this tool helps

RetireGuide™: This feature differentiates Betterment from other robo-advisors. RetireGuide™ provides you with personalized retirement planning advice based on your goals.

RetireGuide™ will:

- Evaluate income when you retire (based on your current investments)

- Make plans based on the availability of Social Security

- Determine how much you should save each year

This feature also lets you evaluate your entire retirement picture by including your 401(k) plan and other external accounts. Seeing the current balance of your taxable and non-taxable accounts shows your total net worth.

Ultimately, this tool provides advice on what you need to save and where to invest it across your entire portfolio.

SmartDeposit: Do you like to invest money throughout the month? That is the premise behind SmartDeposit. SmartDeposit allows you to invest money once your bank account reaches a certain balance.

Tax-Saving Strategies

Other investing apps only offer traditional or Roth IRAs to reduce your investment taxes.

With Betterment, you get several built-in benefits that can reduce your taxable income from investing. Unless you only invest with a Roth IRA, most passive income is taxable. Paying fewer taxes means you have extra cash to invest and you can earn more compound interest.

Charitable Giving: It’s possible to donate directly to various charities from your account. Betterment will also let you see your potential tax savings. However, this option is only available for long-term gains.

Tax-Coordinated Portfolio: This exciting feature helps Betterment make tax-efficient investments to boost your after-tax performance. For example, Betterment may hold more bonds in your IRA because they earn more taxable income than stocks. Your taxable account might have more stocks as a result.

Bear in mind that this feature only works with Betterment accounts. While you can sync external accounts for investment reviews, this data doesn’t influence the asset allocation Betterment chooses for you.

Tax-Loss Harvesting+: The robo-advisor can sell funds for losses to offset your taxable gains. According to Betterment, you might be able to offset up to $3,000 in ordinary taxable income each year.

Personal Support

Live Support: Betterment offers phone and chat support five days a week. You can ask questions about setting goals or navigating the platform. However, the support team cannot provide personal advice.

Premium plan members get unlimited phone access to CFP professionals. You must have at least $100,000 with Betterment to qualify for Premium.

Investment Review: Betterment created this feature to analyze and score your outside investments based on four areas: investment accounts, tax savings, fees, and risk exposure.

The Investment Review feature is free to use. It is a great way to ensure your investments are in shape and that you’re not missing any opportunities.

Advice Packages: It’s possible to schedule financial planning sessions when you need them. You can plan for major life events or get an in-depth portfolio review. These one-time advice calls start at $199 and last 45 minutes.

On-demand financial advisor access: Having at least $100,000 with Betterment gives you complimentary access to certified financial planners. Keep in mind you will need to upgrade to the Premium pricing plan to enjoy this perk.

Cash Reserve

Most bank accounts are notorious for their low interest rates. If you want your spare cash to work harder, Betterment Cash Reserve is an option.

Betterment Cash Reserve is an FDIC-insured product and offers an APY of up to .10 percent. This is one of the highest rates in the market and offers FDIC insurance of up to $1,000,000.

Most online banks only let you make a maximum of six withdrawals each month. Betterment lets you make unlimited withdrawals.

Married couples can open a joint Cash Reserve account and get up to $2,000,000 in FDIC insurance.

Like Betterment’s investing options, it’s free to open a Cash Reserve account. You must make an initial deposit of at least $10, but you do not need to maintain a minimum account balance.

Betterment Checking

There is also a free FDIC-insured checking product up to $250,000 called Betterment Checking. You might pair this product with the Cash Reserve feature to sweep money between accounts.

This feature has no minimum balance requirement or fees. You also get a free Visa debit card for local and online shopping. A fun new feature the advisor has added to the debit card is the ability to earn cash back on your shopping when you use the card.

Offers are personalized on your shopping history and there is no minimum to redeem rewards. They automatically apply earnings to your checking account balance.

Betterment reimburses fees at any ATM that accepts Visa, accounting for roughly 2.8 million spots worldwide. However, there is a one percent fee on all foreign transactions. Instead of looking for an in-network ATM, you can quickly get cash as you need it.

In addition to enrolling in direct deposit, you can deposit checks from your mobile device. The app is available for Android and iOS devices and lets you access your investment accounts.

Instant money transfers are available with Zelle and other apps such as Venmo and Cash App.

Despite the many free features, online bill pay and paper checks are not available. Betterment is exploring adding these features in the future. In the meantime, you can schedule bill payments through the merchant’s website.

Betterment also plans to offer a joint checking account. For now, you and your spouse can open separate accounts.

Fees and Pricing

Betterment has low fees that are competitive with most robo-advisors.

Annual fees for your investment account are either 0.25 percent or 0.40 percent. If your investment account has a $0 balance, you do not pay a fee. Additionally, you don’t pay any fees if you only open a checking or cash reserve account.

There are no trade commissions to buy or sell ETFs with Betterment.

You will pay annual ETF expense ratios between .07 percent and .12 percent for most funds. The fund manager retains this fee from your dividends.

This fee stays the same whether you buy the fund with Betterment or use another investing app.

Currently, there are two different pricing plans:

- Digital – .25 percent and no minimum balance requirement

- Premium – .40 percent and a $100,000 minimum balance requirement

Regardless of the tier, your account balance determines your total fee. If you have over $2 million with Betterment, you receive a .10 percent marginal discount on balances over $2 million.

The main difference between the tiers is that you get unlimited calls with CFPs with the Premium tier. Aside from that, almost every feature is the same. However, you can buy one-time advice calls with the Digital plan if you need expert insight.

Pros and Cons

There is a lot to like about Betterment. However, it’s not a perfect platform.

Pros

- Recommends a goals-based asset allocation

- Invests in cost-efficient stock and bond index funds

- Automatic rebalancing

- Tax-loss harvesting

- Free cash management and checking accounts

- Financial advisor access

- No minimum account balance to open

If you’re a new investor and want to start investing, Betterment simplifies the process. The app creates portfolios based on your goals and makes sure you don’t have to figure out too much on your own. It doesn’t get much simpler than that.

Cons

- Annual account fee

- Tax-coordinated investing doesn’t sync with external accounts

- Cannot manage your own investments

- Unlimited financial planner access is only for Premium plan

While Betterment is the most established player in the robo-advisor space, there are other options worth considering. Here are a few of the top investing apps for beginners.

| Betterment | M1 Finance | Stash |

|---|---|---|

|  |  |

Read Review | Read Review | Read Review |

Beginner-friendly | Commission-free trading | Beginner-friendly |

Completely automated | Automated rebalancing | Easy-to-use mobile app |

No account minimum | $100 account minimum | No account minimum |

12 months commission-free | No signup bonus | $5 signup bonus |

Who is Betterment Best For?

This is a good option for investors of any experience level, including:

- New investors

- Busy parents and professionals

- Long-term investors

- Index fund investors

- Retirees wanting a low-risk bond portfolio

Betterment makes building a goal-based portfolio easy. It’s possible to start investing in a few minutes.

Instead of spending hours researching which funds to buy and creating an asset allocation, Betterment does the hard work for you. You will invest in many of the largest index ETFs.

However, the robo-advisor might not be the best fit for you if you’re comfortable managing your own portfolio. Most investing apps no longer charge trade commissions on ETFs.

This means you can use the same asset allocation and avoid Betterment’s annual fee.

Betterment Review

-

Commissions and Fees

-

Tools

-

Ease of Use

-

Investment Options

-

Customer Service

Betterment Review

Betterment is a leading robo-advisor that offers low-cost advice for investors. If you need assistance in managing your investments and reaching your goals, it’s a good resource to use.

Overall

4.2Pros

✔️ No minimum account balance to open ✔️ Full breadth of tools to manage your investments and cash ✔️ Incredibly affordable to use ✔️ Uses a goals-based approach to manage your investments ✔️ Free tax-loss harvesting

Cons

❌ Minimal options for experienced investors ❌ Can’t include external accounts in your recommendations ❌ Can’t manage your own investments

Summary

Betterment is one of the best options if you want to start investing and need help. Their fees are low, you get a diversified portfolio, and you can invest small amounts of money. As your investing skills grow, you can open a DIY account elsewhere to buy individual stocks or sector ETFs.

Remember, you can open an account with Betterment with no minimum balance.

What challenges are you facing with investing in the stock market? How often do you look at your investment portfolio?

I’m John Schmoll, a former stockbroker, MBA-grad, published finance writer, and founder of Frugal Rules.

As a veteran of the financial services industry, I’ve worked as a mutual fund administrator, banker, and stockbroker and was Series 7 and 63-licensed, but I left all that behind in 2012 to help people learn how to manage their money.

My goal is to help you gain the knowledge you need to become financially independent with personally-tested financial tools and money-saving solutions.