My first job out of college was working at a bank, and I was surprised at how often I was asked how to write a check. Since I got my first checking account when I was 15 and knew exactly how to fill out a check correctly, I had no problem answering that question. In those days, checks were a common form of payment.

However, today, it seems ancient. I know when I go to the store and stand behind someone paying by check, I have no patience. You likely deal with the same emotion.

But what if you have no other option to pay a vendor? It can be hard to write out a check for the first time. Paper checks have multiple parts, and you may not be sure where to put everything.

If your only encounter with the financial instrument is asking yourself, ‘where can I cash a check near me?’ it may seem impossible to determine how to properly write a check. Thankfully, that’s not the case.

Our comprehensive guide breaks down what to do, step by step. You’ll learn how to write a personal check, how to write a check with cents, the different parts of the financial instrument, and several other helpful hints.

Table of Contents

How to Fill Out a Check

It is easier than you think to use this financial tool. With how automated our finances are, it may seem inconsequential to know how to fill out a check.

Despite automation, they are still a thing.

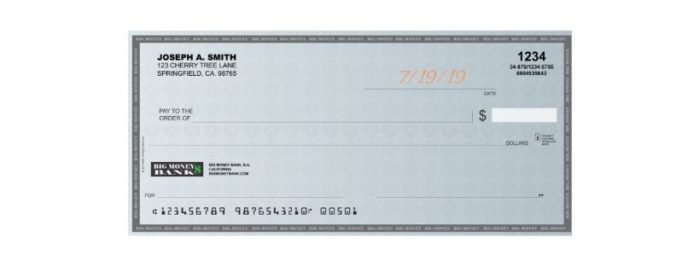

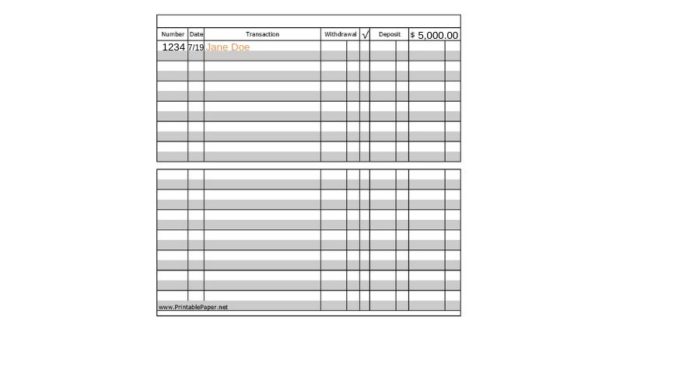

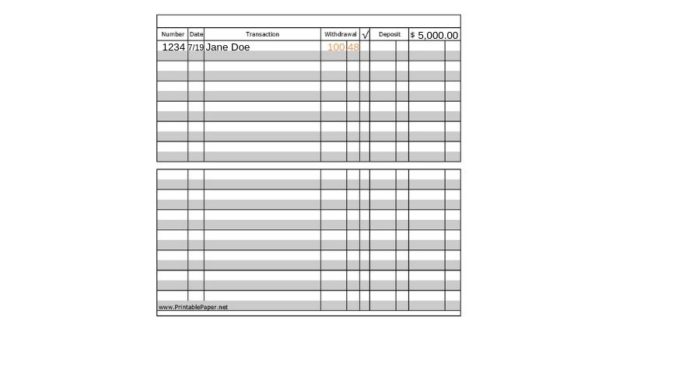

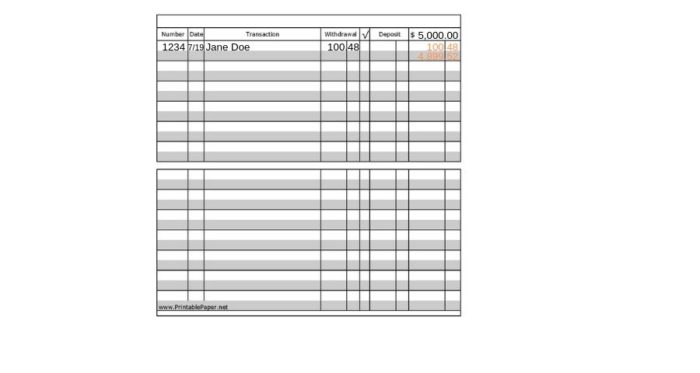

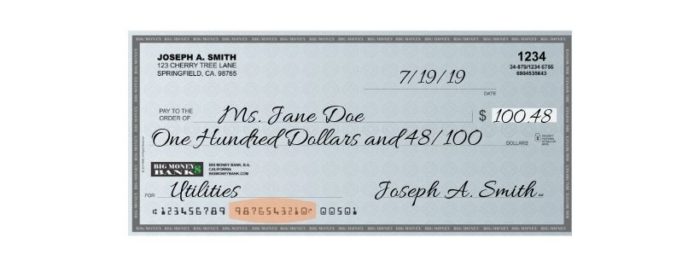

Take a moment to look at the sample check below. You will notice numbers for six different fields on it. I will discuss what you need to do at each number so you know how to fill it out.

1. Date the Check in the Upper Right Corner

The first step to writing a check is filling out the date. In most cases, you want to write the current date.

You may post-date a check (meaning you date it later than the current date)in some circumstances, but you typically want to use the current date.

You can use any format you like for the date. Using the original publication date of this article, you can use either July 19, 2019, or 7/19/19.

If you want to abbreviate the month when filling out the date, that’s fine, too.

2. Write Out The Recipient

The next step in the process is to write out who you’re paying. You do this in the “pay to the order of” field. This can either be an individual, an organization, or a store such as Walmart.

When you write a check to someone, you want to use both the first and last name. If it’s to a business, make sure to use the entire name of the business.

The most important part of this step is to write clearly and legibly to avoid any confusion.

3. Write Out the Amount You Want to Pay in Numbers

This field is directly below the date field. Similar to the previous step, you want to clearly write out the amount you want to pay in numbers.

It’s essential to make a clear distinction between the dollars and cents.

A clear decimal point is the best way to do that. For example, you can write the amount as $100.48. You can also write the amount as $100 48/100 if you prefer.

4. Write the Payable Amount Using Words

This may seem like overkill, but the next step is to write the amount using words. Doing this confirms what you write out in step three.

*Related: Looking for the best place to get rid of your coins? Read our guide on the best places that offer free coin counting near me and avoid the Coinstar fee.*

You will write the amount in words directly below the “pay to the order of” field. Again, clarity in your writing is key.

You don’t want the recipient or bank to be confused about the amount of the check.

Using the same amount as step three, you want to write out the amount of the check in dollars and cents. Here is how that will look: 100 dollars and 48/100.

If you have room left in this space after the cents, it’s good practice to write a line to the edge of the field so nothing else can be added.

5. Complete the Memo Section in the Bottom Left

In the bottom left-hand corner of the check, you will see a “Memo” field. It is not required to complete this section, so you can skip it if you like.

I like to use this field when paying for something. We monitor our spending, and we use this field to track our household budget expenses to ensure we’re not overspending.

You can do the same, depending on payment – “mortgage,” “car payment,” and “utilities” are all good examples.

6. Sign the Check in the Bottom Right

The final step to filling out a check is to sign it in the bottom right-hand corner, where the sample says, “Your Signature Here.” This is an easy step to overlook, but it’s important not to forget.

Unsigned checks are not valid tender, so it’s vital to complete this step. Like other steps, make sure to sign your name legibly like you would any other legal document.

You’re done! If you’ve followed all of the steps, your check should look similar to the below sample.

How to Write A Check for Cash Withdrawal

You may wonder ‘how to write a check for cash withdrawal’ and not know how to do it. Thankfully, it’s not that much different from paying someone.

The key difference comes at step two of the process.

Instead of making it out to someone else, you either write “cash” or your name in the “pay to the order” field. Everything else is the same.

*Related: Need to go to the bank, but not certain if it’s open? Read our guide on what banks open today near me to learn what banks are open for business*

Ask the bank or retailer how they want the check made out before completing it to ensure you do it the way they want.

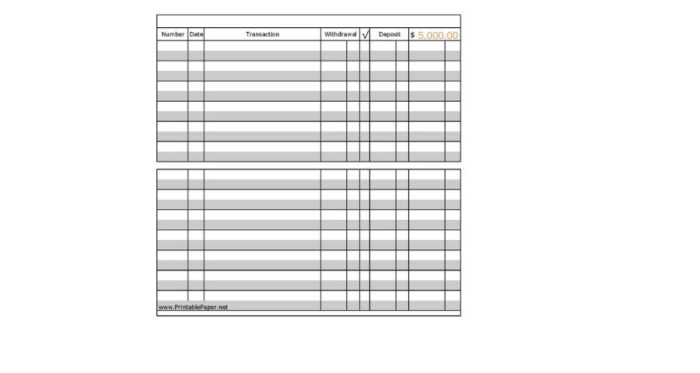

How to Fill Out A Register

Now that you’ve written a check you’re done, correct? Wrong! There is one other step to the process. You want to write it down in your checkbook register.

This helps you do one crucial thing – track your spending. Tracking your spending is one of the best ways to grow your wealth, and if you don’t write down the amount of your check, it’s difficult to know where your money goes each month.

It’s also difficult to know exactly how much money is in your account.

When filling out a register, you track a few pieces of information. Those are:

- When you wrote the check

- Who the check was made out to

- The amount of the payment

You want this information when you receive your monthly bank statement as you can verify the amount and if it has cleared.

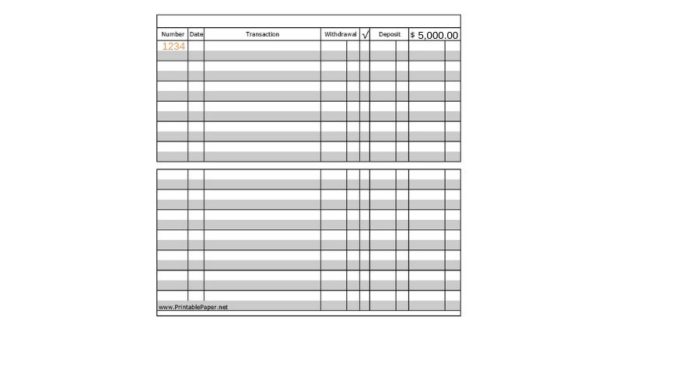

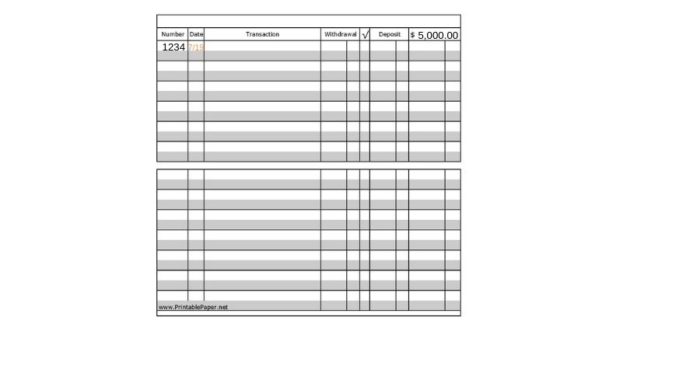

Here’s how to fill out a check register:

Enter your starting balance on the first line. This is what you currently have in your checking account. Let’s use $5,000 as an example.

Write down the check number. This goes in the “check number” field on the far left of the register.

Write down the date. This should go just to the right of the check number, in the “date” field.

Write out who the check went to. This is in the middle of the register, in the “transaction description” field. You want to put the company or individual paid in this section.

Write down the amount. This is key, of course. You write out the amount of the check in the “payment/debit” section. On a side note, deposits go in the “deposit/credit” section.

Determine your new balance. You do this on the far-right area of the register, under the “balance” field. This lets you know how much money you have in your account.

You should follow the above process for each check you write, and for each transaction in your account. This may seem like a lot of work in the beginning, but it’s a great way to stay on top of your finances.

Other Items You Need to Know

There are more pieces to a check than what you make it out for and the date. There is also vital information on the piece of paper that businesses and financial institutions use for verification.

Here are three parts of a check you need to know about:

- Routing number – this is a nine-digit number on the bottom left of a check. This tells institutions where you bank.

- Account number – this is to the right of your routing number. This tells institutions your account number.

- Check number – this is on the far right of the check, and obviously is your check number. It’s vital this number matches the number listed in the upper right-hand corner of the instrument.

You can see an example of those parts of a check in the above sample.

Frequently Asked Questions

Have other questions before you write a check? Below are some commonly asked questions many have before starting.

When would I use a check?

This depends, but you typically use a paper check when you need to pay someone. Sometimes it’s a cheaper payment option as some retailers pass on the credit or debit card processing fee to you.

In this instance, it saves you money.

*Related: Do you need to purchase a money order? Read our guide here on the best places to buy one for cheap.

In other instances, you may have no other payment options. For instance, our utility provider only accepts checks or automatic debit. You may face something similar and need to write a check.

Can I write a check with a pencil?

Yes, you can use a pencil but it’s a horrible idea. It’s easy to erase pencil and someone could change the amount.

To protect yourself against this kind of fraud or theft, It’s best to use a pen.

What should I do if I make a mistake?

We’re all human, and it’s easy to make a mistake on a check. Common mistakes are:

- Not signing the check

- Writing differing amounts in the numbers and words section

- Using an incorrect date

An unsigned check is easy to fix as the vendor may return it to you to sign. The other mistakes may require you to void it.

Voiding a check is easy to do, you either write “void” in large letters across the check or write large “Xs” across the check.

How do I write a voided check?

This is easy to do as described above. You may also need to provide a voided check to your employer to establish a direct deposit or to a vendor for an automatic debit.

Simply write “void” in large letters across the check and give it to the provider.

Why are there two fields for the amount on a check?

This is to help businesses and banks know the correct amount. Essentially, it’s another way to verify the amount of the check, and is a good way to avoid fraud.

Should I post-date a check?

A post-dated check is one you write with a future date. Using the publication date of this article, it would be a check I write with the date of August 19, 2019.

You may need to post-date a payment because you have insufficient funds at the time or paying for a future service.

Many who write post-dated checks think they are safe and the funds won’t come out of their account until at least the date they write it.

That is a myth. Bankers often don’t pay attention to the date and will cash it regardless. A signed check is a legal form of payment; if you don’t have the funds to cover the check prior to the future date, you’re at risk of the check bouncing.

Is a personal check the same as a certified check?

A personal check is one you write to an individual or vendor and is only backed by the funds in your account. A certified one is backed by your bank.

They take the funds from your account and give you a check drawn on themselves. These are typically needed for larger transactions, such as buying a car with cash or the closing of a mortgage.

Summary

It may feel like paper checks are no longer a thing, but they’re still a tool used by many to manage their finances. While we may see checks go obsolete in the future, reports show they’re not going anywhere soon.

Even if you don’t use checks on a regular basis, it’s helpful to know how to write a check correctly to avoid potential problems.

How many checks have you written in the past year?

I’m John Schmoll, a former stockbroker, MBA-grad, published finance writer, and founder of Frugal Rules.

As a veteran of the financial services industry, I’ve worked as a mutual fund administrator, banker, and stockbroker and was Series 7 and 63-licensed, but I left all that behind in 2012 to help people learn how to manage their money.

My goal is to help you gain the knowledge you need to become financially independent with personally-tested financial tools and money-saving solutions.

Leave a Reply