We all have financial goals. And we certainly want to reach them. Sometimes we can get in our own way and be our own worst enemy without even realizing it. If that’s you, cheapskates can be your best guide. Here are 12 things you can learn from cheapskates that will help you reach your financial goals.

Table of Contents

Spending Emotionally

We all have bad days, and we all have times to celebrate. A cheapskate spends judiciously, not emotionally. Practicing the former is the road to saving money. The latter leads to wasting money, and often debt.

Paying Full Retail

A frugal person understands that full price is not for them. Instead, they look for sales, use coupons, or some other way to save on their purchases. We’re wise to do similar.

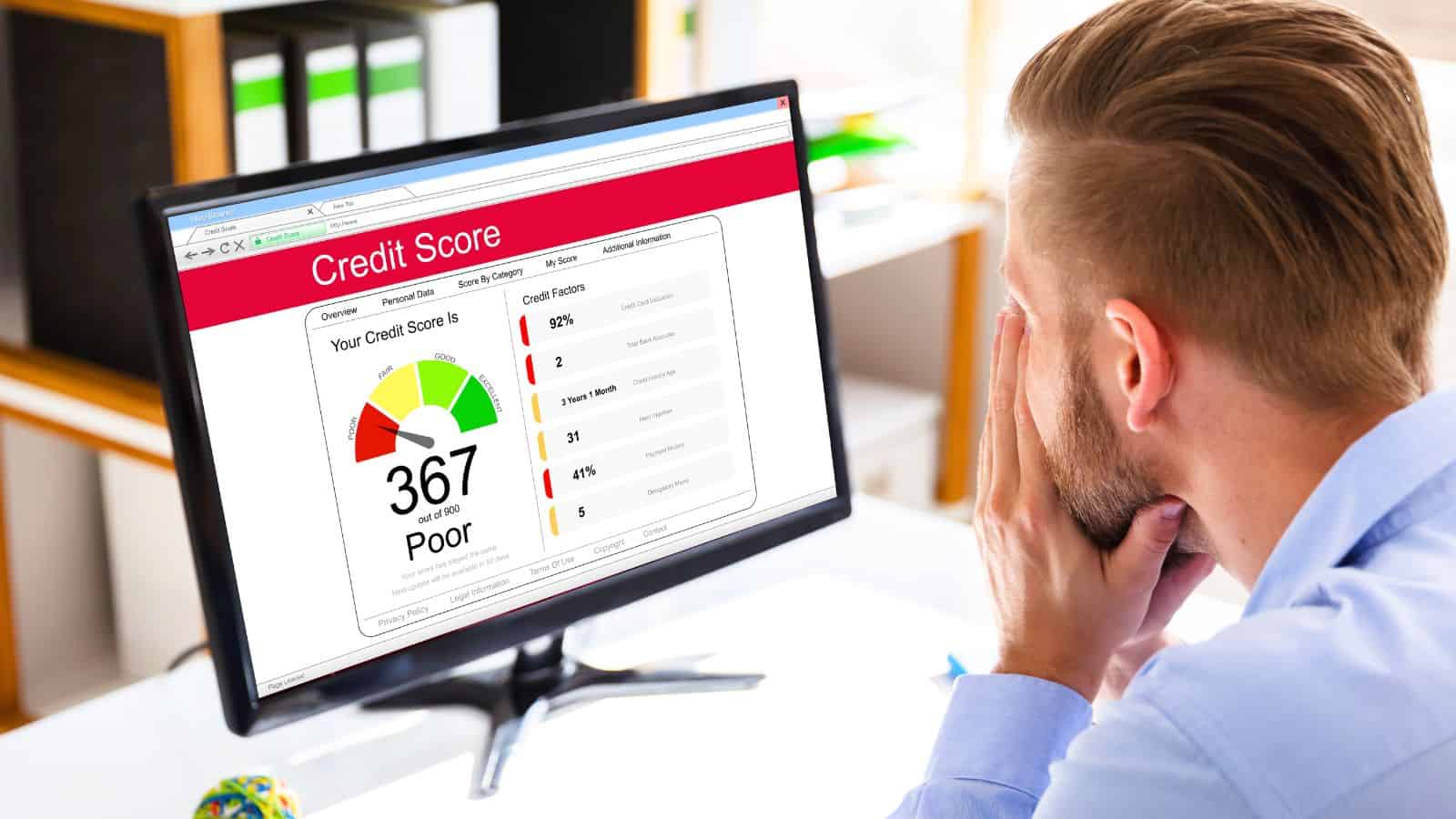

Ignoring Their Credit Score

A cheapskate knows that when they have to borrow money, they want the best rate possible. As such they watch their credit score to ensure they’re doing what’s needed to keep it high.

If you plan on borrowing money in the future, or perform other financial transactions, ignoring your credit score isn’t wise.

Carrying A Credit Card Balance

Frugality and high-interest debt? That’s an oxymoron. Cheapskates pay their cards in full every month, if they use a card. They also take advantage of rewards credit cards to get something back for what they do have to spend.

Throwing Away Items They Can Use

Cheapskates love to reuse items to stretch their budget. Sure, it can go too far. However, they always look for other ways they can reuse an item before tossing it.

If they can’t, they determine if they can sell the item and reinvest the proceeds to replace it.

Staying Away From Investing

Frugal people know the importance of saving for the future and they don’t run from it. Furthermore, they look for ways to do it as cheap as possible.

If you want to grow a sizable portfolio, you’re wise to start now and keep management costs at a minimum.

Keeping Cable

Cheapskates and cable? That’s an anathema. True cheapskates use an over-the-air antenna to get their local networks, get movies from the library, and use free streaming services to watch TV shows and movies.

You can do similar and save upwards of $200 a month.

Buying Bottled Water

Bottled water is convenient, but a frugal person sees it as unnecessary. Instead, they purchase a Brita Water Filter and a reusable water bottle.

The average American spends $100 a year on bottled water. That’s $100 a cheapskate can put towards other needs.

Spoiling Their Children

Children are a gift. Cheapskates don’t shower them with gifts as that adds needless expense. And, they look for ways to involve them in doing chores around the house. With an allowance, they help their children learn to see the value of a dollar.

We should follow suit to help prepare children for their future.

Upgrading Their Phone Annually

It’s not very frugal to upgrade to the latest iPhone annually. A cheapskate uses their phone until it dies, then replaces it with a modest choice.

While the latest technology can be fun, we should emulate this to keep our budget in check.

Buying Something Because It’s “A Good Deal”

Buying something on sale is a great way to save money. Unfortunately, this doesn’t mean it’s free.

If you buy something you can’t afford just because it’s a good deal, you’re going to hamstring your ability to reach your financial goals.

Going Out to Lunch

Everyone loves to socialize with co-workers over the lunch hour. But, going out for lunch can be expensive as many meals out can cost upwards of $20.

Instead, a cheapskate brown bags it. If they can join, great. If not, they’re happy to keep the money in their pockets. Time away from the office can be great, but don’t let it derail your financial goals.

Money-Saving Madness: 15 Times Cheapskate Behavior Took Frugality Too Far

There’s saving money, and there’s being miserly. Here are 15 ways being frugal crosses the line into being a total cheapskate.

Money-Saving Madness: 15 Times Cheapskate Behavior Took Frugality Too Far

Cash-Saving Experts: 11 Things Cheapskates Evade Without Fail

Money-savvy people love to save money on everything, but there are some things they won’t do. Here are 11 things cheapskates avoid at all costs.

Cash-Saving Experts: 11 Things Cheapskates Evade Without Fail

Frugal but Fabulous: 10 Things Even Cheapskates Splurge On No Matter the Cost

Frugality is great, but you don’t always need to keep costs to a minimum. Here are ten things cheapskates splurge on, regardless of the potential cost.

Frugal but Fabulous: 10 Things Even Cheapskates Splurge On No Matter the Cost

35 Proven Ways to Save Money Every Month

Many people believe it’s impossible to save money. Or, they think saving $20 or $50 a month won’t amount to much. Both are incorrect. There are many simple money-saving tips that can add up to big savings. You just have to start one, then another, to increase your savings.

Ways to Save Money Every Month

Money Mistakes Millennials Must Stop Making

No one is perfect, but Millennials continue to make certain money mistakes. Here are ten financial mishaps Millennials need to stop falling for.

Money Mistakes Millennials Need to Stop Making

I’m John Schmoll, a former stockbroker, MBA-grad, published finance writer, and founder of Frugal Rules.

As a veteran of the financial services industry, I’ve worked as a mutual fund administrator, banker, and stockbroker and was Series 7 and 63-licensed, but I left all that behind in 2012 to help people learn how to manage their money.

My goal is to help you gain the knowledge you need to become financially independent with personally-tested financial tools and money-saving solutions.

Leave a Reply