The first time we logged onto our online mortgage account after we paid off the balance, it was great to see those three little words: PAID IN FULL. It was even in all caps, which seemed to make it that much sweeter. If you have been able to pay off your mortgage, you know the feeling.

It’s gratifying, liberating and so many different things all rolled into one. It’s ironic, but after working so many years in the banking industry helping people qualify for mortgages, I really had no idea what happens after you pay off your mortgage until I paid off my own.

However, it was something I was more than happy to learn through personal experience. Here’s what happens after you pay off your house.

Table of Contents

You Receive Some Documents

When you got your original mortgage, you had to sign a mortgage note and deed of trust, which stated the loan terms and allowed the lender to place a lien against your house. After you pay off your house, the lender may send that original note and deed back to you, although some don’t.

If you don’t receive yours back, at the very least your lender should send you a payoff notice to show you now have a zero balance on your home and a notice of your lien being released.

If you’re worried about it, after a couple of months, you can check with a title company to ensure that their lien has been removed from county records or pull your credit report to make sure your mortgage account shows a zero balance.

You Update Your Taxes and Insurance

Because most people escrow the taxes and homeowner’s insurance associated with their property, it’s important to update your mortgagee after you pay off your mortgage. There should be no mortgagee associated with either entity once you own your house free and clear, and all it takes is a simple phone call to your insurance agent.

If your house burned down and your lender was still the mortgagee listed on your homeowner’s policy, you’d have to deal with them before you could even get your insurance check, and that would certainly delay the process.

For tax purposes, since you are now responsible for paying your annual property tax bill, you want to make sure you receive the invoice instead of your old lender. If you forget and miss the invoice, you will face a pretty hefty late penalty.

You Gain a Sense of Freedom After Paying it Off

Although I’m not exactly primed for retirement just yet, I do feel a sense of freedom now that I don’t owe anyone any money. For instance, I quit my banking job a year and a half ago because I didn’t like working at a job that felt monotonous, and now I feel like I can do whatever it is I want to do, like freelance writing.

I make less money at freelancing than I did with my day job, but because I no longer have debt, that’s okay. I’m not chasing that dollar anymore. Instead, I’m doing something that I enjoy while making money at it, and I couldn’t be happier.

Allocate Your Mortgage Payment Elsewhere

Typically, a mortgage is the last debt that you pay off, due in part to the fact that it’s probably your largest debt. Making that last debt payment is a surefire way to commit yourself to staying debt free for the rest of your life. After that last payment is made, you can kiss debt goodbye for good (or kick it out the door if you prefer.)

When you pay off your mortgage, you can put that money that you were using to pay it down each month toward other things. While you could just spend the money, a much wiser move would be to allocate it toward other financial goals.

For example, you could put half of it toward college saving for a child and half in a brokerage account – here’s a list of the top online brokerages in the space to invest. Or, you could put it toward any other number of concrete goals you are working toward (saving for a car or other purchase, for example.)

It can be difficult to know how to allocate those extra funds and manage all your financial accounts. It’s easy to let something go unnoticed or simply not recognize money making opportunities.

Once you pay off your mortgage you have even more money you can put to work for you so it’s important not to miss those opportunities. One good way to manage the extra cash flow is to put the funds in a high yield savings account until you decide what to do.

Banks like CIT Bank pay 1.55 percent in their money market with a minimum $100 balance, let you stay liquid for the time being and earn something on the cash until you decide what to do.

Betterment is an excellent option if you want to invest your additional funds. The robo-advisor has no minimum balance requirement and manages your investments for you.

Investing in the stock market isn’t the only investment option out there. You can invest in commercial real estate through Fundrise with as little as $10.

RealtyMogul is another good option to invest in real estate. You need to have $1,000 to start, but has lower fees than Fundrise.

If you currently have credit card debt, you can transfer to 0% APR credit cards to avoid paying interest. This also works if you have home updates you’d like to make and want to take advantage of no-interest options.

You can also take advantage of travel options with travel rewards credit cards if you’ve spent most of your disposable income the past few years to pay off your mortgage. Using travel rewards cards is a great way to help reduce the overall cost of travel and something we take advantage of on a regular basis.

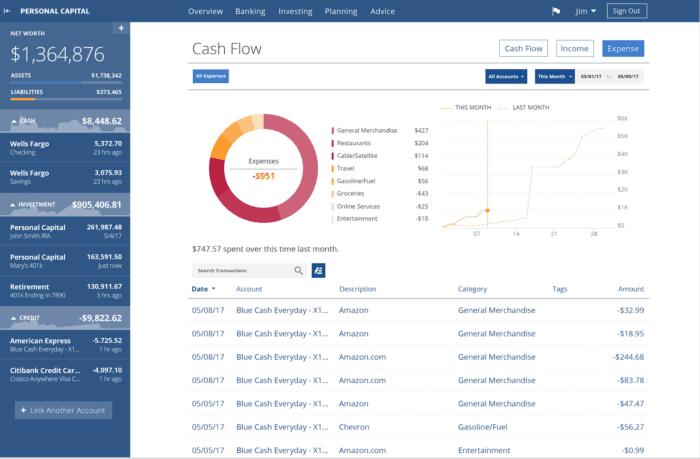

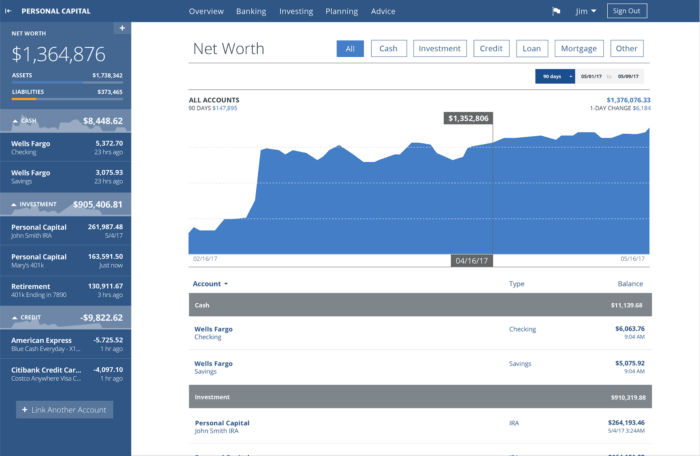

All that being said, the best way I’ve found to find opportunities and manage our finances holistically is Personal Capital. Personal Capital is a free to use platform that connects all your financial accounts in one place.

You can combine banking accounts, brokerage accounts, credit cards, mortgages but, that’s paid off, monthly bills and more. Our personal favorite is to start investing those funds.

As you can see in the screenshots below, Personal Capital allows you to track your spending, analyze investments against their benchmarks, provide a tax analyzer, monitor your net worth and much more.

Obviously, after you pay off your mortgage you will have quite a bit in excess funds to use for other long-term goals. By using a free tool like Personal Capital you can stay on top of your entire financial picture, directing it on the course you choose.

Bottom Line

Once you do finally make that final payment, I think it’s entirely appropriate to treat yourself to something nice to celebrate. I don’t normally like to say, “You deserve it,” but if you’ve officially reached debt free status then I do think you deserve to take a break and enjoy something you had to do without while paying off your debt.

Enjoy a fancy dinner out with your significant other and drink too much wine. Take a day or two off work and travel to a bed and breakfast for a long weekend. Go to an expensive amusement park if that’s what floats your boat. You’ve reached the end of your goal, so now it’s time to breathe a sigh of relief and celebrate a little.

Additional resource: If you’re in a similar situation and want to invest some of your excess funds but don’t know where to look, check out one of my favorite brokerages – Betterment. Betterment is the top robo-advisor in the space. They manage your investments for you in low-cost index funds and have proprietary tools that help you maximize your specific tax situation and longer-term retirement goals. The best part – they offer this at a fraction of the cost you’d pay a traditional financial advisor!

Open your Betterment account today!

Have you paid off any huge debt recently? How did you celebrate? Have you paid off your mortgage? If you still have debt, are you planning on doing something special once you’re debt free?

I’m Nicole Schmoll – a master’s-educated professional writer, mompreneur, and co-founder of Frugal Rules.

As a freelance copywriter in Omaha, I still believe that writing is an artistic expression. Every time I strike the keys, I intend to evoke a response from my listeners. I left my full-time career as a senior copywriter for an insurance agency to start my own freelance writing business.

I love watching and writing about TV (and how to stream it!)

I hope you did celebrate! It’s a wonderful accomplishment, congratulations!

But it’s also a very good reminder that there will be some details that you’ll need to take care of, like making sure that your insurance and property tax bills are properly routed.

Thanks, Emily! We did end up eating a quiet sushi meal (read: no kid) as a little celebration. It was small and simple.

We have a very small mortgage and I prepay it every month. I cannot wait to be done with it! I am also anticipating the pay-off dates for our two rental properties. It shouldn’t be too long at this rate.

At that point, you two will probably be close to your early retirement goal!

Updating your taxes is a big thing. Most counties are not known for being overly pro-active about sending out tax bills. Last year about this time, I started freaking out because we hadn’t received any tax bills at our new address. Thankfully, we managed to get it cleared up a few days before we incurred penalties.

That would make me panic, too. I have this silly fear that I won’t get my tax bill for years and that I won’t remember it until they auction off my house for tax liens. Silly, huh?

That’s a pretty awesome accomplishment! I think a lot of the average folks have a plan to spend that extra money each month so I really like the idea of treating yourself. That way you reward yourself but don’t enter into a bad habit of spending it every month. We’d probably take a small trip or do a really nice tasting menu to celebrate. Not having a mortgage puts a ridiculous amount of cushion into the budget. I felt the same way when we paid off the student loans but the mortgage payoff will be a factor of 6 times sweeter. The banker said, “You’ll own the house in 2043.” and I thought, “Unlikely to be later than 2023.”

Congrats on debt free status!

Um, wow, I can’t believe your banker actually said that to you! That sounds kind of snotty. I wouldn’t have been able to keep my mouth shut.

I think they kind of have to. It was said when we were running through the HUD-1 and some closing documents detailing that we have to make 360 monthly payments. “So with your rate of 3.5% here’s how much you’ll pay in interest and the house is yours 30 years from next month. 2043.” I decided to keep my thoughts to myself as we had a difficult time getting money on a short timeline. Our first mortgage program fell through because we made $2,000 a year too much based on a bonus check that was paid the month before. I tried to tell them that’s not an every month thing but no dice. We ended up needing a regular mortgage with PMI which sucked so we paid down 20% as fast as we could.

For what it’s worth, I worked in mortgages for over 7 years, and there’s nothing a banker has to actually say to you at a closing– anything that needs to be disclosed is all in the paperwork.

Are you going to have a mortgage burning party? Kidding. I don’t think that’s a good idea.

But yes congratulations! Now you can build wealth, woohoo! ^_^

We definitely considered it! 🙂

Congrats, Robin! That’s a huge accomplishment. We have a lot in student loans so I’m looking forward to the day that those are gone and we can start allocating it towards other things. I pay our student loans with side hustle money so it’ll be nice to divert that income towards investments or travel.

Thanks, DC. That’s awesome that you can pay your student loans with side hustle money, though. That means you’re clearly doing well with your side hustle.

We still have a qays to go on that front, but I imagine it’ll be very fun to see the PAID IN FULL message. Then, like you said, it’s just a matter of making sure we get the tax and insurance bills.

After that, we’ll put that mortgage payment into an account to save up for a down payment on a rental property. I know, I know. We party too hard.

Yes, you guys definitely need to take it down a notch! 😉

We are investing the extra as well– so boring, right?? (I’m okay with being financially boring!)

I can’t wait to own a property free and clear. We have 4 years until our first rental property is paid off and then we’ll snowball that payment into the others. Congrats on reaching such a significant goal at such a young age.

4 years isn’t that long at all. You guys are well on your way to debt freedom!

I’ve heard a lot of people say they “feel freedom” or how Dave Ramsey says that the “grass feels different under your feet” after you pay off your mortgage in full. That didn’t happen for me. I paid off my mortgage 3 years ago in my early 30’s and now I just feel even more pressure to properly allocate what was once a $1500 mortgage payment into appreciating assets for retirement.

I also don’t feel much freedom because if I don’t pay my property taxes, the local government can seize my house. It never feels like I truly own it.

It’s odd, but I never felt relief; it’s more of an indifference.

Does anyone else who has paid off their mortgage have a similar experience?

I did feel freedom, but I tried that whole grass thing, and it didn’t work for me. Sometimes I try to look at my walls and think– they’re all mine now– but it still feels the same… and then I feel stupid for trying to feel something about my walls. 🙂

But I understand where you’re coming from about the pressure to invest well. When we were paying off the mortgage, it was a set thing we had to do, so there wasn’t as much pressure. Now that we’re investing more heavily, it’s a little more intimidating. Weird, but so true, and I hadn’t thought about it that way until I read your comment.

We plan to have our mortgage paid off in about 9 months, and will most likely have a nice dinner out to celebrate. We’d also like to direct a couple months of our extra income to help the homeless in some way. After that we’ll divert that income toward college funds and retirement accounts, as you mentioned. Congrats on being PAID IN FULL!

Thanks so much, Kalie! Love that you guys are only 9 months away. That’s nothing!

I paid mine off over the phone yesterday. The mortgage website says I owe them $0.00. I’m waiting for the payoff statement to come in the mail and am curious what that will consist of. It shouldn’t be much. When I got off the phone after paying them I was so excited, still am. It’s hard to even express the excitement I feel and it is a huge feeling of relief to not have a mortgage payment anymore. Unfortunately I’m not debt free though. I just bought a new car last year plus have a few credit cards. My main objective now is paying off my credit cards then paying extra on the car to pay it off sooner.

It took us 8 years and 4 months to payoff our mortgage. We tried to double the payments every month we could, knowing what we and our kids gave up on the non-essential items. The grass and wall didn’t feel any difference, but I notice that job that I have always been grateful to have is now even more pleasant.

It is hard to describe this feeling to girlfriends who value exclusive/limited edition in bags, shoes, cars, and dining experience. Not everyone is lucky enough to have a spouse who is always happy to pay.

I also noticed a difference in working after you become debt free. It becomes more pleasant because you realize you aren’t quite so reliant on that job anymore.

I paid off my mortgage 4/20/16, exactly 22 years, 7 months and 21 days! It was a long haul, having refinanced from initial 30 yr @ 8.5% including PMI for many years, refinancing over the years until I got it to a 15yr @ 4.5%. Then I started increasing that payment by $400 each month and I decided to take the tax refund and some savings to pay it off this week since my savings paid all off .92 interest. This is a great feeling especially since I am single and have done this all by myself. And now I plan to start saving that payment into a remodeling account, get the house exactly as I want it before I retire within the next 3 years, if you can pay it off early…do it, its a great feeling of relief and accomplishment! Thanks for the tips on what I need to expect next and I will be checking on all my documents.

Congrats, Sheila! Your accomplishment is even more amazing because you did it on your own. You should be proud!

On January 1st, 2013, realized that We could not retire early because of cars, credit cards and a mortgage. since then we have paid off the cars and credit cards and the equity and mortgage will be paid off by Christmas 2016. We are already feeling the pressure lifting from the debt we had. And the enjoyment at my job is coming back as the weight of the debt is being lifted away. Investing will be started back up in 2017 with hopes the market will let it grow to hit our goals. you always have taxes and insurance even if you rent (although if you rent the tax bill is hidden in the rent).

Congrats, very cool Tim!

One major effect of paying off your mortgage is that is will hurt your credit score. I just paid off my mortgage and my score dropped by 39 points with a reason of: Account status changed to: Paid in full.

Good point & good to know James. Though, I bet you’ll take the decline in exchange for being mortgage free. 🙂

The problem is that I was expecting to take the proceeds to buy a new house for my now larger family. The hit to my score effects the interest rate I can get.

Got ya, that makes sense. Do you think it’ll bounce back in time so as to take advantage of a better rate?

Is that true, your credit score drop?

Yes, it is possible Rosie – especially if you don’t have any other installment type loans. It points back to one of the problems with the credit scoring system. That said, I’d rather have a paid off mortgage with a lower credit score than a hefty mortgage with a higher score. 🙂

Planning on paying my mortgage off next week. Took out a small 401k loan to do it, but it will take me from about $1200 a month on the mortgage payment (I paid about $300 extra each month) to paying $360 a month on the loan. Fair trade-off i think, and with the savings difference i’ll pay off the loan in 2 years or less.

THEN i can start saving for the remodeling jobs i want to do on the house…lol

Very cool, congrats Richard! Lol, that’s the way to do it though. 🙂

I am not a financial planner but I am about to pay off my mortgage.

Richard and John, you need to really look at all of the factors before taking out a loan to pay off a mortgage. Richard, your monthly payment may have gone down but unless you had a very high interest rate on the mortgage I don’t see how you can pay less a month AND pay off the loan earlier. Additionally you have tied up your 401K money and you can no longer deduct the mortgage interest.

Generally the mortgage is the last debt to pay off early. It almost always has the lowest interest rate. An exception would be if you have a car loan and home loan at the same basic interest rate or where the car rate is actually lower.

Taking out a loan to pay off the mortgage is usually not a good idea. One exception might be if you can get a 0% interest credit card and pay that off but normally this will be low balance amounts, like $10K or so and the interest saved over a year will be about $400.

Congrats on the mortgage payoff Ollie, that’s great!

I appreciate your sentiment but I think you’re not thinking this through correctly here. I’ve written extensively on the site about how I do not think 401(k) loans are a good thing.

However, everything is not black and white. In Richard’s case, he seems to have it planned out and indicated that he’d have the loan paid back in two years, or less. Assuming he’s done the right planning that’s a winning proposition. I may not choose to do it, but if he did it wisely (which it seems that he did), then I have no problem at all with it.

Ultimately, we don’t know the entire situation – we can only go off what he left in his comment, so I think it’s not the best to judge.

Hi Robin,

Thank you for this article. It is a valuable reminder of my soon to be achieved goal of debt freedom. I have just 3 more payments (basically 3 months) left on my mortgage. By the end of the three months, it would have taken me a total of 13 years and 4 months to pay off a 30-year mortgage. This is how I have tackled many of my installment debt. I am feeling free already, and can’t wait to see the PAID IN FULL message in my account.

Again, thanks;).

Hello John and all, I have a question about fed taxes on a rental property. Once the property is paid off, how much does the rental property get taxed as one obviously can’t take a loss. Thanks

That’s a good question Tom. I unfortunately don’t know, you’d likely want to speak with a tax person, or someone else who invests in real estate to get their input.

Thanks for replying John. Maybe someone will chime in?

I owe 3,000 on my mortgage. I hope to have it paid off in two to three months.

Eating cheaply (can of tuna mixed with a box of stuffing etc), cutting TV, cutting internet, combining trips, shopping for used items and such.

I will hit the roof by jumping for joy when it’s finally paid for.

I’ll have one car loan left when the mortgage is paid off. I’m going to celebrate with nice thick juicy steaks for a couple of months before I focus on my last debt.

That’s awesome Timothy, congrats!

Searching around for tips for after payoff and found this, very good information!

I paid off our mortgage this morning! I had been making a lot of extra payments anyway, this is the end of March and I was already paid up until November…I hate owing money!

Going forward, I’m taking half or more of what would be the payment and putting that into savings each month.

Although it took a lot (lot!!) of work, I managed to payoff a 30-year mortgage in 12 years! 🙂

Very awesome, congrats Bryan! That sounds like a great problem to have. 🙂

What are the fees involved in paying off mortgage in full? Is there a way to avoid extra fees?

To my knowledge, there’s no real way to avoid fees when paying off a mortgage. I do know it’s dependent on the bank the mortgage is with and if they have any prepayment penalties. They city where you live might also have minor paperwork related fees but isn’t that crazy from what I’ve seen.

Paying it off is the way to go , I paid of my fixed 30 year mortgage last week , in 11 years instead of 30 years and along the way I refinanced to buy an investment property. I feel an unbelievable sense of relief. I’m in my 50s with 2 kids to put through college,so I know where the extra money will be going

Awesome work Ann! We’re on track to kill ours within about 11 – 12 years, after starting with a 30 year mortgage. We’re looking forward to being completely debt free. 🙂

I am paying off my first home which is a rebtal. I own two homes. I purchased the home in 2012 and just before my 36th birthday I will be mortgage free on the first one! I am so excited! It was a 5 year goal but 7 isn’t bad!!!

Nice work!