Getting your finances in order can feel overwhelming, especially when you don’t know where to start. Thankfully, there are many personal finance tools and apps today to make managing your money easier than ever.

Take financial planning, for instance. Having a personal financial plan used to be reserved for the wealthy. Apps like Savology have changed all that.

If you need a financial plan, this app will help you make one for free in five minutes. Here, we review the features, pros and cons and help you decide if it will help you get your financial house in order.

Table of Contents

What is a Financial Plan?

A financial plan is a roadmap for your money. Challenging times and unexpected circumstances become harder without a financial plan.

Having a financial plan means having a purpose for every dollar you make and every dollar you spend. It has three pieces:

- Clear financial goals

- Specific financial milestones

- Contingency plans

With a financial plan in place, you can continually improve your finances. When unexpected events occur, they won’t wreck you financially. Part of your plan should also include how you will handle ‘what ifs’ like reduced pay or losing your job.

Free Financial Planning?

Savology really does help you create a financial plan for free. It fills the gap for many people who want to get financial planning help but can’t afford to pay a financial planner to manage their money for them.

After you successfully sign up and create a free account, you receive personalized recommendations called action items. These show you what steps to take next. You also receive a financial report card that grades your finances across 12+ categories. Together, you get a snapshot of your financial well-being.

The app offers planning modules and activities like quizzes, surveys, calculators, and tasks to help you improve your financial knowledge.

Who is it Good For?

Many people believe you only need a financial plan if you’re wealthy. That’s not true. Financial planning is for everyone.

As the manager of your own money, it’s critical to reinforce good financial habits, get rid of the bad ones, and make steady improvements to reach your goals.

Having a tool help you manage major life stages and events like getting married, starting a family, landing a new job, or saving for retirement makes financial planning easier. It also keeps you moving in the direction of financial independence.

Getting Started With Savology

Getting started and creating a free account or plan takes about five minutes. Just click “Get Started” to take a financial survey and create your account.

Depending on your answers, current financial situation, and goals, the initial onboarding survey will consist of around 20-30 questions. These questions will ask about your current savings, debt, retirement plans, and how you’re managing your financial risks.

The survey is organized into five sections.

1. Personal Profile

This includes your name, age, gender, location (via zip code), and whether or not you are married or have any dependents.

2. Savings and Income

This includes your estimated annual income, current savings habits, and types of retirement and non-retirement investment accounts you currently have, along with their balances.

3. Assets and Liabilities

This section addresses the types of assets you own along with the estimated value of each asset; the types of debts and liabilities you have in your name; total amount of debt; whether you own your home or rent; and your credit card usage habits.

4. Risk Management

Estate plan and insurance details are noted here, including your life insurance needs.

5. Retirement Outlook and Financial Goals

The last section is dedicated to your desired financial outcome. You’ll be asked when you want to retire, the type of lifestyle you wish to live throughout your retirement years, and the state of your current health.

Your answers across all five sections are used to create your personal account and financial plan. Responding honestly and completely is important.

The more transparent you are, the more accurate your plan and recommendations will be.

Product Features & Offering

After creating your free plan at Savology, you’ll immediately get access to several beneficial features that complement your financial plan and help you better understand your finances.

1. A Financial Plan

Your financial plan is broken down into four major areas:

- Savings and income

- Assets and liabilities

- Risk management

- Retirement outlook

The plan provides both a high level overview of the four sections, along with detailed explanations and breakdowns for each sub-section,. The following critical calculations are included.

- Your savings rate

- Your emergency fund needs

- Your life insurance needs (showing a gap or surplus)

- Your other insurance needs

- Your calculated net worth

- Your debt-to-income ratio

- Your estimated retirement age and income

Your plan contains everything you need to see your current financial situation and improve it.

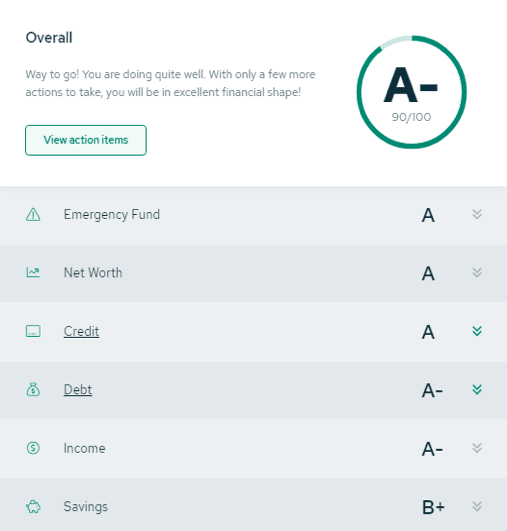

2. Financial Report Card

Just as it sounds, this is a report card that grades your finances. More specifically, your report card takes a ‘snapshot’ of your current financial picture. It provides grades across 12+ different financial categories as a way of showing positive areas, and those requiring more attention.

These categories include: credit, debt, income, housing, savings, retirement, emergency fund, and insurance.

Your report card includes letter grades and descriptions for why you received them. It also offers suggestions for improvement.

As and Bs show areas in which you’re doing well, while Cs and Ds make it easy to see what areas you need to consider addressing first.

3. Action Items

These are larger steps to take based on your financial goals (retirement outlook) and areas to start improving right away.

Each action item explains why it is recommended, how it benefits your overall financial plan, and how to complete it.

As you finish action items, new ones will appear, keeping your financial to-do list filled with important tasks.

4. Planning Modules and Activities

Planning modules enrich and improve your financial literacy. The financial literacy quiz and budgeting tool are particularly informative. This is an area where the app could improve. Module content could be more robust.

5. Savology Stars

Who doesn’t like gamification, and being rewarded for things that actually benefit you? The app’s gamification feature lets you earn stars through a variety of different ways such as sharing the platform with your friends, completing action items, finishing modules, and performing activities.

Stars unlock additional platform features, discounts with select providers, and can even be redeemed for swag items such as t-shirts, mugs, and wallets.

Pros and Cons

Here’s a quick breakdown of the pros and cons of the platform.

Pros

- Free to use (with a paid model coming soon)

- Extremely fast

- Complimentary report card included

- Several financial literacy components within the app

- No ads or intrusive pop-ups

- Great experience and extremely easy to navigate

- Visual and actionable steps

- Good mix of high-level and specific breakdowns

- Great, reputable service providers recommended (all or vetted and checked)

Cons

- List of providers is still growing

- Planning modules in beta and not all are available

- Plan requires manual updating (a planned paid plan will offer automated updates)

- Not all features are unlocked

Additional Things You Need to Know About Savology

Here are a few additional things to consider about the free financial planning app.

1. It is Free to Use

There are many personal finance tools and money apps that offer a free-trial model. This isn’t one of them. Signing up, creating an account and accessing your financial plan is entirely free.

Considering it can cost up to $2,500 to get a financial plan from a traditional or fee-based planner, that’s significant money saved.

2. It Makes Money Through Affiliate Relationships

The app currently earns revenue through affiliate and partnership models with financial service providers that users have access to in their plans.

Partners compensate Savology when users are directed towards their services and take action. This amount varies from provider to provider and depends on the type of service offered.

It’s important to know that even though the app’s primary revenue stream is through this model, there are several providers on the platform for which the company is not compensated.

3. A Paid Subscription is Coming

The company has communicated it is considering offering a paid version of the app soon. This paid offering will include additional plan features such as integrations with your bank account and other financial tools.

Summary

If you don’t currently have a financial plan and would like help creating one, Savology is an excellent option to consider. Its easy to use platform and free features help you see your current financial situation and how to improve it.

The fact that it is both free and fast make it worth a look.

How do you manage your financial planning? What is one area you want to improve in financially?

I’m John Schmoll, a former stockbroker, MBA-grad, published finance writer, and founder of Frugal Rules.

As a veteran of the financial services industry, I’ve worked as a mutual fund administrator, banker, and stockbroker and was Series 7 and 63-licensed, but I left all that behind in 2012 to help people learn how to manage their money.

My goal is to help you gain the knowledge you need to become financially independent with personally-tested financial tools and money-saving solutions.

Leave a Reply