This is a sponsored conversation written by me on behalf of PolicyGenius. The opinions and text are all mine.

Mention the phrase “health insurance” and you’re bound to get a range of heated responses. If you’re like many, health insurance costs are a significant part of your monthly budget or you don’t know how to find the best plan for your family. Thankfully, there are more tools coming into the marketplace that aim to simplify the entire health insurance purchase process. One such option is PolicyGenius.

Our Personal Health Insurance Situation

I’ve shared before about our health insurance. We have a pre-Obamacare plan and prior to us moving this past year, the total cost of our premiums plus our monthly HSA contribution was more than our monthly mortgage. Now, it’s slightly less, but you get the point – we spend a lot for our health coverage.

You may wonder if we have medical issues. We don’t. We’re all relatively healthy, only visiting a doctor four times, in total, as a family in 2016. Basically, we’re paying for protection against a hypothetical worst-case scenario in the event something drastic happens. Going through the Exchange on Healthcare.Gov in December didn’t provide any relief – with the lowest plan for our family coming in at over $1,400 per month!

What Shopping for Health Insurance is Typically Like

Raise your hand if this is what shopping for health insurance is like for you.

If you’re lucky enough to get coverage through an employer, you’re given a packet of information with little assistance based on your specific situation.

The information largely talks about the importance of coverage and usually only covers cost – not a thorough comparison of the benefits and provisions of each plan. Left confused and defeated, you pick the cheapest plan because it hurts the least.

If that sounds unpleasant, let’s consider buying coverage on your own. You go to Healthcare.Gov or your local marketplace site, input your information and go blind when you see all the details and cost. While they provide some resources, you’re left feeling defeated, confused, or both and hope the plan you purchase will work for your family.

Simplifying Shopping for Health Insurance

Sticker price aside, shopping for health insurance can be a challenge. If you don’t know the jargon or don’t deal much with coverage it can be overwhelming. As a result, costs and challenge have left millions who are still without coverage. PolicyGenius helps mitigate the challenge component of getting coverage.

I’ve reviewed PolicyGenius before as an option to buy life insurance. Their platform simplifies the life insurance process decision to a matter of minutes – providing access to tools and explanations so you can make a confident purchasing decision. Having worked in the insurance field in the past, that’s a game changer versus how buying coverage used to be.

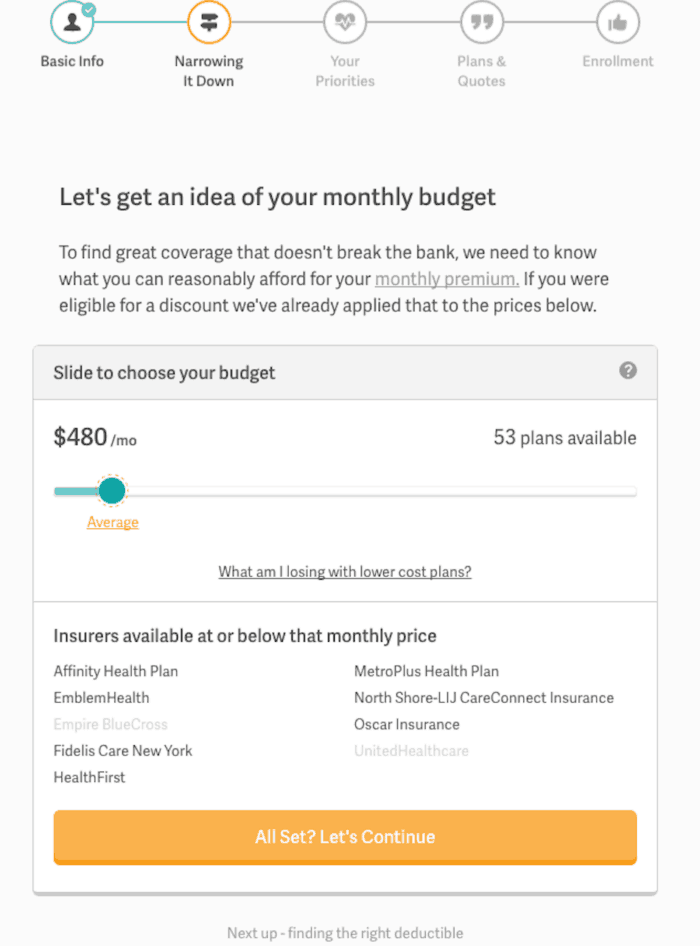

PolicyGenius has brought the same mindset to their new health insurance tool. I’ve had the chance to test out the new health insurance platform by PolicyGenius and found it to be relatively simple to walk through. The platform works very similarly to their life insurance platform and provides access to all on- and off-exchange plans. You answer a few basic questions about your age, family members and if you/they use tobacco.

*Related: Do you need to buy life insurance? Check out our review of the best term life insurance companies to buy coverage for cheap.*

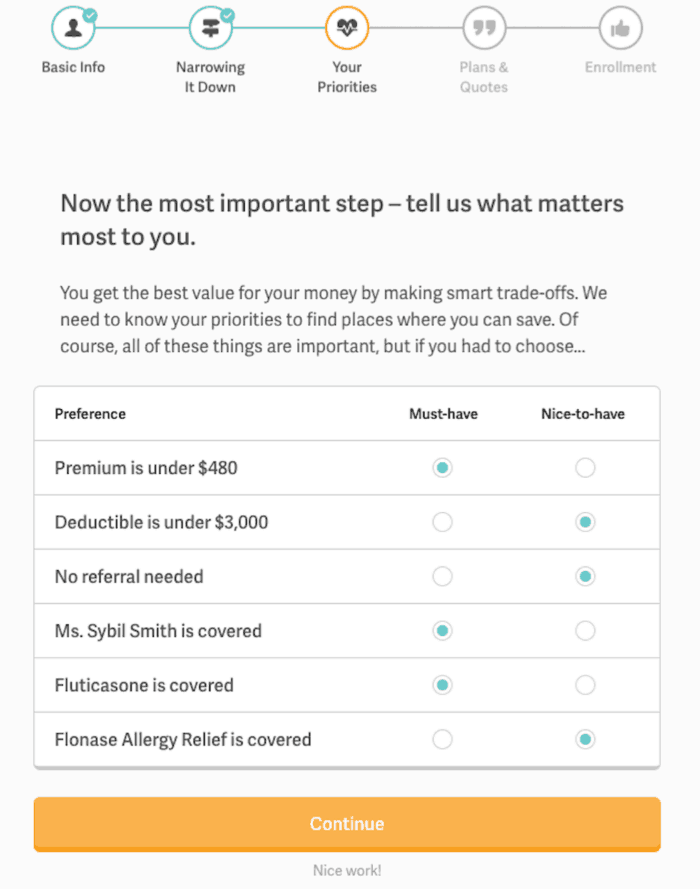

From there, the platform allows you to customize with ‘must-haves’ and ‘nice-to-haves’ – if there’s a particular deductible or certain doctor you must have you provide the information. It took me a total of maybe five minutes to progress through the platform to the point of coverage options. Once you find an option you like, PolicyGenius connects you with that provider and you complete the process with the chosen provider.

There are two main things I like about using the PolicyGenius platform. First, there is a clear and understandable explanation of benefits. If there’s something you don’t understand, PolicyGenius provides resources to help you understand.

Second, and more importantly, PolicyGenius offers access to real-time help through their health insurance platform. Through each screen of the platform, they have a button you can click to either email or instantly chat with a health insurance expert.

I didn’t use that offering personally, but I can see how it would be a significant help to those walking through their health insurance questions with expert level assistance – for free. This can give you peace of mind so you know what you’re buying upfront and that it’ll cover the needs of you and your family. Now, if we could only lower the cost of health insurance.

How much do you pay for health insurance each month? What challenges have you faced in buying health insurance? Does your employer provide coverage and, if so, how much do they cover?

I’m John Schmoll, a former stockbroker, MBA-grad, published finance writer, and founder of Frugal Rules.

As a veteran of the financial services industry, I’ve worked as a mutual fund administrator, banker, and stockbroker and was Series 7 and 63-licensed, but I left all that behind in 2012 to help people learn how to manage their money.

My goal is to help you gain the knowledge you need to become financially independent with personally-tested financial tools and money-saving solutions.

Leave a Reply