It’s that time of the year again; time to prepare your taxes. With that, I’m doing an H & R Block review to share my experience using their platform. We have a professional tax advisor due to the growth of our business, but prior to that, I used the H & R Block platform for many years to do our taxes.

TurboTax is the key player in the space, though H & R Block is no slouch either. I always found the H & R Block platform to be robust and had the tools I needed to get our taxes done with confidence.

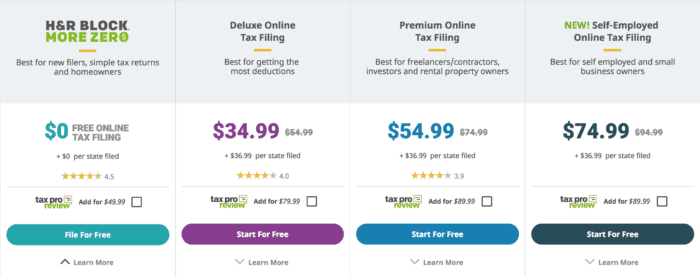

What I love most about the H & R Block platform is that if you’re just doing a straightforward 1040 EZ or 1040A then your Federal filing is free! If you’re taking advantage of the free Federal filing, they also charge nothing to do your State return – at every other level, they charge $36.99 for a State return. With that out of the way, let’s get on to the H & R Block 2019 review.

Table of Contents

What I Love About H & R Block Online

Over my time using H & R Block I’ve come to find a number of things I really like about the platform. Some of those items are:

- The price for a simple and straightforward 1040 EZ or 1040A is free. You can’t beat free.

- H & R Block online makes it simple to import data from the previous year. With just a few clicks you’re ready to go with your tax information from last year.

- You can import or manually input your W-2 info.

- The H & R Block platform has a clear workflow that walks you through each category with an overview telling you what’s needed for it.

- It asks questions to help you input the correct information and make sure you’re not missing any overlooked tax deductions.

- If you need a certain form, you can find it in a variety of ways. If you only know part of the name or only the number it locates it for you.

- If you’re stumped by a certain section, the H & R Block platform allows you to bookmark sections and come back to them later.

- H & R Block has a new print return feature if you would like a paper copy and allows you to save your return as a PDF. They allow you to do this for each of your prior three years’ returns.

- H & R Block offers free in-person audit support if you need it. Neither TurboTax or TaxACT offer that!

Drawbacks to H & R Block

Nothing is perfect, and such is the case with the H & R Block system. While I do like the platform overall, below are a few of the things that could be improved upon, such as:

- There is limited ability to move ahead by sections. This is actually a good thing, but if you’ve been doing your taxes for a number of years it could lead to a little frustration.

- The H & R Block platform is not the cheapest option available. There are other platforms, like TaxACT, E-File or eSmart Tax that are cheaper – though you pay for the cheaper option. The H & R Block online platform is significantly more robust than that of either of those so there is good value there – especially if you have a more advanced return to prepare.

Bottom Line

Like I mentioned in the beginning, I prepared our taxes using the H & R Block platform for a number of years. I always found the system intuitive and easy to use. In fact, if it wasn’t for our growing business I very likely would still be using it to prepare our taxes.

It also goes without saying that the tax law changes this year can pose questions for many. I’ve read that the H & R Block 2018 interface has a great system in place to help you walk through that in a clear and understandable way so you know what your tax impact may be.

Add that to the H & R Block accuracy check and maximum refund guarantee and they’re worth considering for your tax needs. If that’s not enough, they also offer 5 to 10 percent back on top of your Federal return to be used at over 40 different retailers.

File all of your taxes for free with H & R Block today!

Do you do your own taxes? How much do you pay to get your taxes done?

Photo courtesy of: Chris Murphy

I’m John Schmoll, a former stockbroker, MBA-grad, published finance writer, and founder of Frugal Rules.

As a veteran of the financial services industry, I’ve worked as a mutual fund administrator, banker, and stockbroker and was Series 7 and 63-licensed, but I left all that behind in 2012 to help people learn how to manage their money.

My goal is to help you gain the knowledge you need to become financially independent with personally-tested financial tools and money-saving solutions.